Surgalign Holdings disappointed with its 4Q performance as the company reported a wider-than-expected loss. Further, its FY21 revenue outlook also fell short of analysts’ estimates.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Shares of the medical technology company were down about 14% in Tuesday’s extended trading session.

Surgalign (SRGA) posted an adjusted loss of $1.28 per share in 4Q, much higher than analysts’ estimates of a loss of $0.32 a share. However, it compared favorably to the year-ago period’s loss of $2.72 per share.

4Q revenues declined about 17% year-over-year to $26.2 million but came in marginally ahead of the consensus estimates of $26.1 million. The year-over-year decline in revenues reflects the adverse impact of the COVID-19 pandemic on global elective procedural volumes.

Additionally, adjusted EBITDA loss was $7.7 million in 4Q, an improvement from the year-ago period’s loss of $14.3 million, driven by lower operating costs.

As for 2021, the company forecasts revenues to grow by 7%-10% year-over-year, which implies a range of $109.1 million-$112.2 million. The company said, “Our guidance assumes that global procedure volumes return to normal levels during the second quarter of 2021.” (See Surgalign Holdings stock analysis on TipRanks)

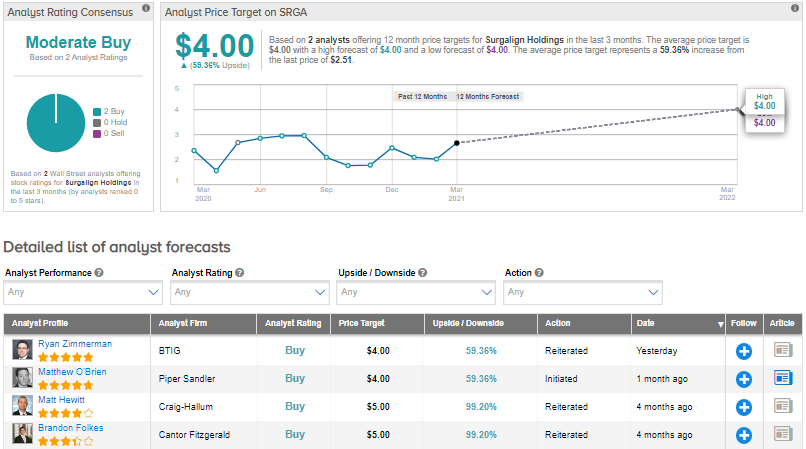

Following the results, BTIG analyst Ryan Zimmerman maintained a Buy rating and a price target of $4 (59.4% upside potential). In a note to investors, the analyst said, “As SRGA transforms into a digital surgery company over the next 12-18 months, we expect a steady product cadence to drive top-line growth combined with the forthcoming FDA [Food and Drug Administration] clearance of ARAI [augmented reality and artificial intelligence] which will complete its first procedures by YE21.”

Zimmerman added, “We continue to view risk/reward as favorable although shares may see some modest pressure tomorrow due to the softer guidance and slightly impacted timelines to ARAI.”

Overall, SRGA has a Moderate Buy consensus rating based on 2 Buys. The average analyst price target of $4 implies upside potential of over 59% to current levels. Shares are down by 8.7% over the last year.

Related News:

PAR Technology’s Strong Bookings Drives 4Q Revenue Beat

Accel Entertainment’s 4Q Revenues Plunge 39%, Miss Estimates

Resonant 4Q Bottom Line Disappoints; Street Remains Bullish