Three Wall Street analysts have cut their price target on Super Micro Computer (SMCI) stock following its weak fourth-quarter earnings and Q1 FY25 outlook. SMCI’s Q4 earnings per share missed estimates, while sales came in marginally above expectations. SMCI shares have lost 17.5% of their value since results released after the markets closed on August 6.

Super Micro builds servers, storage systems, switches, and software that cater to the growing needs of Enterprise, Cloud, AI, Metaverse, and Edge IT Infrastructure segments.

Margin Concerns Lead to Price Target Cuts

- Bank of America – Analyst Ruplu Bhattacharya downgraded SMCI stock to Hold from Buy, citing concerns over declining margins. The analyst cut the price target to $700 (37.6% upside potential) from $1,090 to reflect a notable decline in valuation trends across the sector. He noted that Q4 gross margin came in at 11.3%, significantly below the expected 13.6% due to unfavorable pricing, delayed shipments, and component procurement challenges. That said, Bhattacharya expects SMCI’s margins to return to the normal range of 14% to 17% by the end of 2025, aided by improved customer mix, new platform launches, and overall manufacturing efficiencies.

- Barclays – Analyst George Wang kept the Buy rating on SMCI but cut the price target to $693 (36.2% upside potential) from $1,000. Like Bhattacharya, Wang is unhappy with the declining gross margin. Wang thinks that despite growing revenues and solid guidance, the margin headwinds remain a cause of concern. Wang added that higher manufacturing costs for DLC (direct liquid cooling) racks and an unfavorable customer mix weighed on Q4 gross margin.

- Goldman Sachs – Analyst Michael Ng maintained a Hold rating but cut the price target on SMCI stock to $675 (from $775), implying 32.7% upside potential from current levels. The revised price target represents a 15x near-term EPS multiple, down from 21x guided earlier. Interestingly, the analyst lifted the FY25 and FY26 EPS estimates to reflect the potential for higher revenue growth.

Is SMCI a Good Stock to Buy?

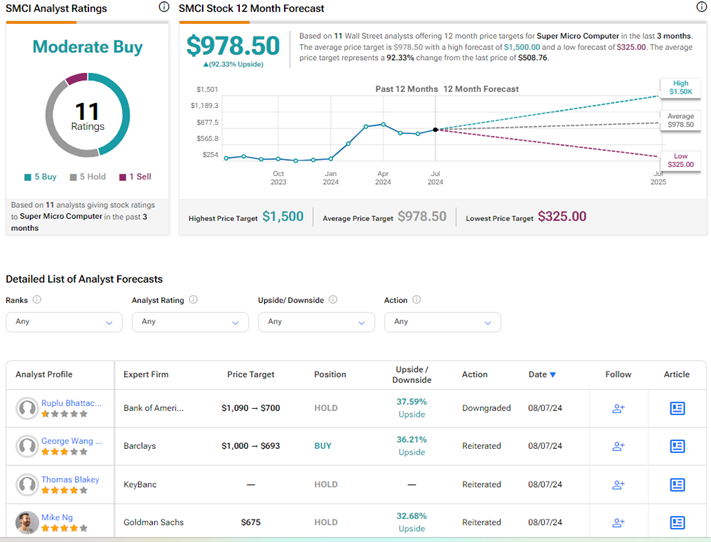

Wall Street remains divided on SMCI stock’s trajectory. On TipRanks, SMCI has a Moderate Buy consensus rating based on five Buys, five Holds, and one Sell rating. The average Super Micro Computer price target of $978.50 implies 92.3% upside potential from current levels. Meanwhile, SMCI shares have gained nearly 79% year-to-date, backed by the artificial intelligence (AI) boom.