Shares of Super Micro Computer (SMCI) plummeted in trading on Wednesday after the company that manufactures AI servers announced a delay in the filing of its annual report. The company cited the need for additional time to evaluate the “effectiveness of internal controls” over its financial reporting.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Despite these developments, Super Micro confirmed that there have been no updates to its previously announced financial results for the Fiscal year and quarter ended June 30. Earlier this month, the company reported a decline in quarterly margins due to rising server production costs and stiff competition from rivals like Dell (DELL).

Short Seller’s Claims Prompt SMCI to Delay Report Filing

This delay comes just a day after Hindenburg Research disclosed a short position in Super Micro, accusing the company of “accounting manipulation.” Notably, Super Micro’s shares have surged by more than 60% over the past year, fueled by the AI boom. However, it remains unclear whether the delayed filing and Hindenburg’s allegations are directly related.

Super Micro has emerged as a major beneficiary of the generative AI surge, with businesses investing heavily in the technology required to power applications such as ChatGPT, helping the company’s stock more than triple last year.

Details of Hindenburg’s Accusations

However, a report from Hindenburg released on Tuesday has accused the company of various issues, including undisclosed related-party transactions and failure to comply with export controls. Hindenburg claimed that its allegations were based on a three-month investigation involving interviews with former senior employees and a review of litigation records.

It’s worth noting here that in 2020, Super Micro was charged by the U.S. Securities and Exchange Commission (SEC) for prematurely recognizing revenue and understating expenses. While the company neither admitted nor denied the SEC’s charges, it agreed to pay a $17.5 million penalty.

What Is the Forecast for SMCI?

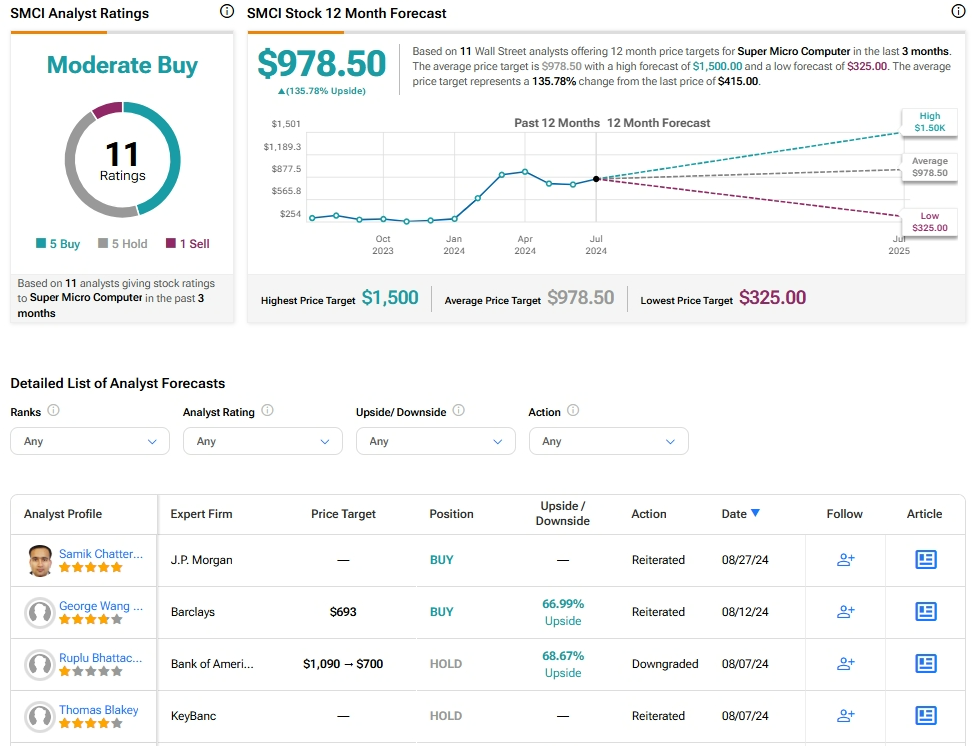

Analysts remain cautiously optimistic about SMCI stock, with a Moderate Buy consensus rating based on five Buys and Holds each and one Sell. The average SMCI price target of $978.50 implies an upside potential of 135.8% from current levels.