Energy solutions provider Sunrun (NASDAQ:RUN) impressed investors with strong third-quarter numbers. Earnings per share (EPS) of $0.96 came much above the Street’s estimate of a loss of $0.06 per share, and increased significantly from EPS of $0.11 in the same quarter last year.

Revenue climbed 44% year-over-year to $631.9 million, surpassing the consensus estimate of $564 million. Sunrun stock rallied 8.5% in Thursday’s pre-market trading session.

The company benefited from robust growth in net subscriber value. As of Q3-end, Sunrun had a customer base of 759,937, reflecting 21% year-over-year growth. Meanwhile, its installed solar energy capacity increased 17% in the quarter.

CFO Danny Abajian said, “The actions we took throughout the year to respond to higher interest rates and material costs have resulted in strong improvements in our Net Subscriber Value, which exceeded our prior guidance, even excluding the benefit from the passage of the Inflation Reduction Act.”

For the full-year 2022, Sunrun expects to increase installed solar energy capacity by nearly 25%. Also, it anticipates to deliver sequential growth in net subscriber value in Q4.

Is Sunrun Stock a Buy or Sell?

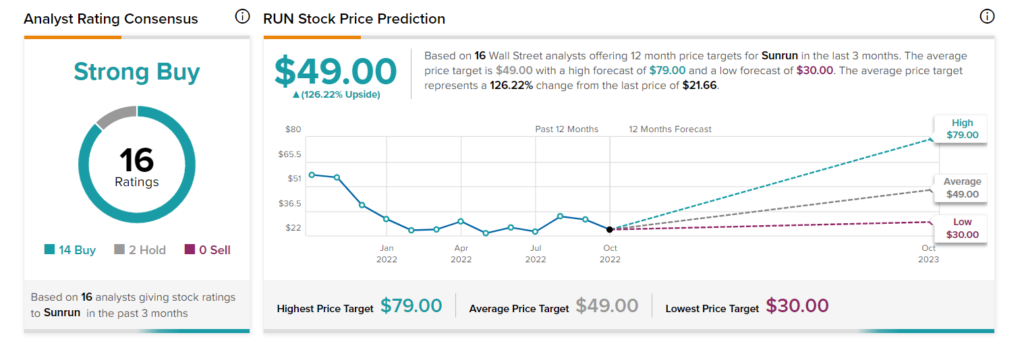

Sunrun stock has a Strong Buy consensus rating based on 14 Buys and two Holds assigned in the past three months. The average RUN stock price target of $49 implies 126.22% upside potential.