Shares of solar company SunPower (NASDAQ:SPWR) tanked by more than 23% at the time of writing after the firm’s auditor quit, according to Bloomberg. Ernst & Young resigned as SunPower’s independent auditor on June 27, as it was unwilling to associate itself with financial statements prepared by management due to allegations of misconduct involving senior executives overseeing financial reporting. SunPower is now seeking a new auditor.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

It’s worth noting that the company also disclosed that it received a subpoena from the SEC in February regarding its revenue recognition practices. Indeed, it is dealing with various challenges, such as the need to restate almost two years of financial results and a general downturn in the rooftop solar market.

Is SunPower Undervalued?

Turning to Wall Street, analysts have a Moderate Sell consensus rating on SPWR stock based on six Holds and four Sells assigned in the past three months, as indicated by the graphic below. After a 77% decline in its share price over the past year, the average SPWR price target of $3.01 per share implies 47.91% upside potential.

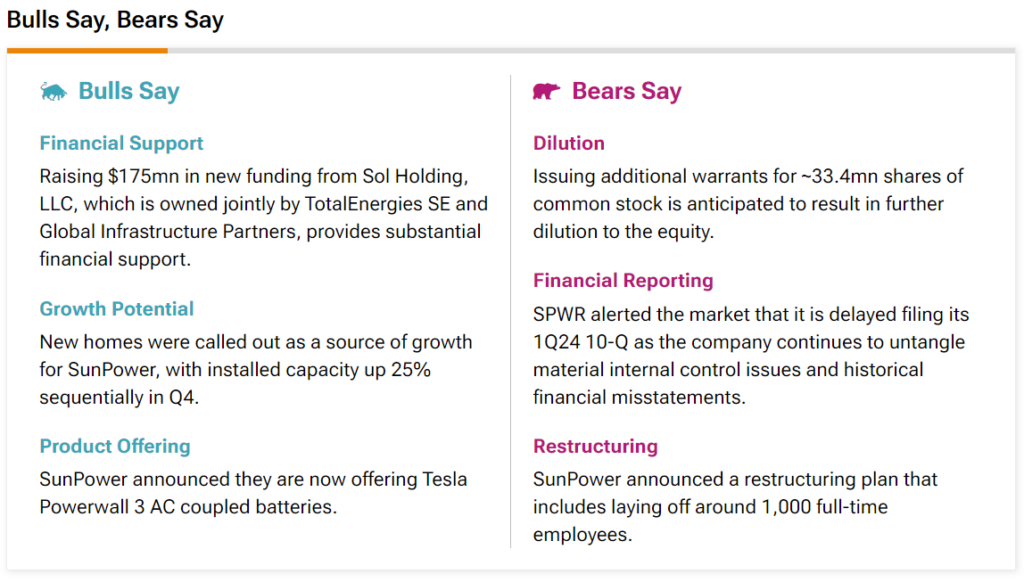

According to the bearish analysts, the company’s issue of an additional 33.4 million warrants is anticipated to further dilute shareholders. In addition, they are not fans of the company’s financial reporting issues or its plans to lay off around 1,000 full-time employees. However, there are some positives. Analysts do see some growth potential in the new homes market, and they like the fact that SunPower now offers Tesla Powerwall 3 AC coupled batteries.