Energy stocks like Suncor Energy (TSE:SU) (NYSE:SU) have long had something of an adversarial relationship with environmentalist groups like Greenpeace. And now, these two groups are taking each other on as Greenpeace filed a complaint with the Alberta government over Suncor’s practices. The news was surprisingly well-received by investors, who gave Suncor a fractional leg up in Thursday afternoon’s trading.

More specifically, Greenpeace filed its complaint with the Alberta Securities Commission (ASC), which alleged that Suncor isn’t keeping up with regulations requiring full disclosure of climate-related risks to its shareholders. The biggest such potential risk, the complaint noted, was related to oil sands projects. Should a low-carbon emissions scenario become a reality, that could leave oil sands projects as “stranded assets,” and investors would take the hit accordingly.

Suncor, for its part, believes that it covered that part sufficiently by noting that huge changes to the global energy system would result in conditions “…where people, companies, infrastructure, and whole industries are made redundant.” This comes at a particularly important time for Suncor as well; it recently spent C$1.47 billion to pick up TotalEnergies’ (NYSE:TTE) Canadian operations. That, in turn, could turn out to be “stranded assets,” as it’s an oil sands project in the Fort Hills area.

Is Suncor Energy Stock a Buy?

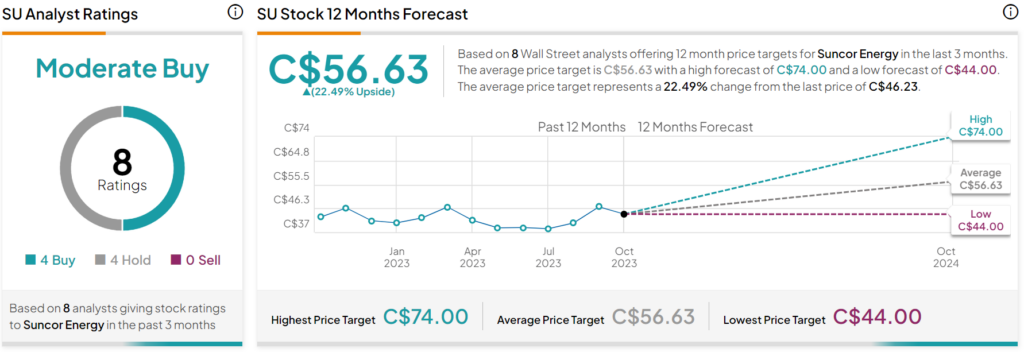

Turning to Wall Street, analysts have a Moderate Buy consensus rating on SU stock based on four Buys and four Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average SU price target of C$56.63 per share implies 22.49% upside potential.