Shares of Sumo Logic are up 5.6% in Tuesday’s pre-market session after the machine data analytics company’s 4Q guidance topped the Street’s estimates. In addition, the company posted better-than-expected 3Q results.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Sumo Logic (SUMO) reported a loss of $0.06 per share, which was smaller than analysts’ estimates of a loss of $0.24 per share and compared to the year-ago quarter’s loss of $1.09 per share. The company’s 3Q revenues grew 28% to $51.9 million and surpassed consensus estimates of $49.1 million.

Sumo Logic’s CEO Ramin Sayar said, “We delivered strong results in our first quarter as a public company as customers continue to choose Sumo Logic’s Continuous Intelligence Platform to transform the tsunami of data generated from digital transformation into actionable insights.”

The company anticipates its 4Q revenues to be in the range of $51.8 million to $52.3 million, which is above the Street consensus of $50.8 million. Moreover, its 4Q loss is expected to be in the range of $0.12 to $0.13 per share, compared to analysts’ expectations of a loss of $0.15 per share.

For fiscal 2021, Sumo Logic expects to post a loss of $0.78 to $0.79 per share on sales of between $200.3 million to $200.8 million. (See SUMO stock analysis on TipRanks).

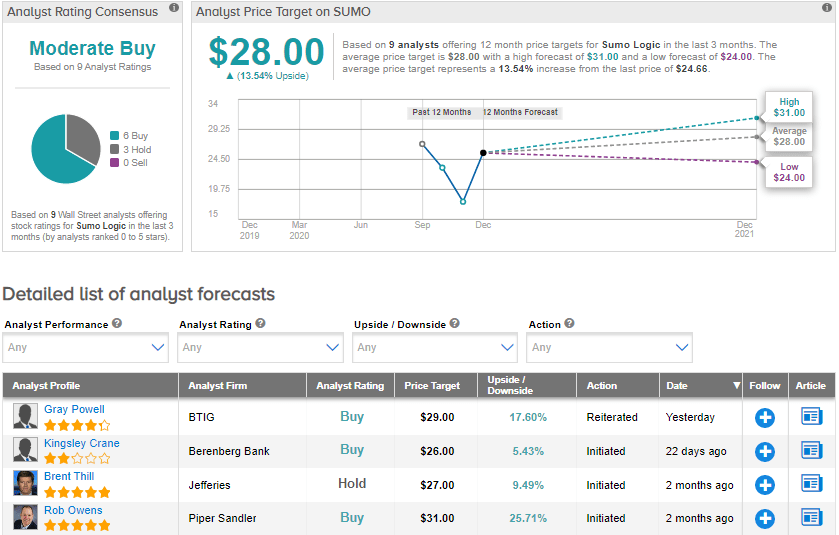

BTIG analyst Gray Powell noted that the company’s 3Q results were “much better than expected” and the upbeat 4Q outlook can be viewed as “evidence of a reacceleration in growth.” He maintained a Buy rating with a price target of $29 (17.6% upside potential) on the stock.

Meanwhile, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 6 Buys and 3 Holds. The average price target stands at $28 and implies upside potential of about 13.5% to current levels. Shares have declined by 8.3% since the company was listed on NASDAQ on Sept. 17.

Related News:

Coupa Lifts FY21 Outlook After 3Q Beat; Analyst Raises PT

HealthEquity’s 3Q Results Beat Estimates As HSA Assets Grow 19%

Stitch Fix Surprises With 1Q Profit; Shares Spike 34%