Constellation Brands (STZ) dipped in pre-market trading after the company reported mixed second-quarter results. The producer of beer, wine, and spirits reported Q2 adjusted earnings of $4.32 per share, up by 14% year-over-year. This was above analysts’ expectations of $4.08 per share.

STZ’s Q2 Revenues Fall Short of Street Estimates

Additionally, the parent of Modelo Beer reported net sales of $2.9 billion, a 2.9% year-over-year increase, though it fell short of Street estimates of $2.95 billion. The company’s management acknowledged that the current macroeconomic environment has put pressure on the broader beverage and alcohol market.

Despite these challenges, the Beer Business segment saw a 6% increase in net sales, driven by a 4.6% rise in shipment volumes. The company’s beer business comprises more than 80% of its revenues.

However, the Wine and Spirits segment experienced a 12% decline in sales, primarily due to a 9.8% drop in shipment volumes, attributed to difficult market conditions, particularly in the U.S. wholesale channel, which affected most price segments within the wine category.

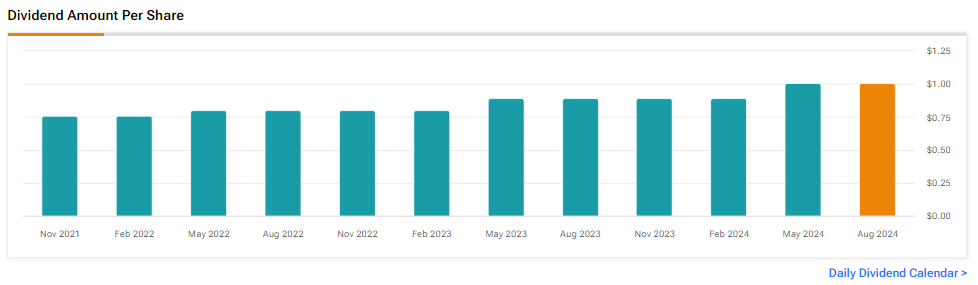

STZ Declares Quarterly Cash Dividend

In addition, the Board of Directors declared a quarterly cash dividend of $1.01 per share of Class A Common Stock, payable on November 21 to stockholders of record as of November 5, 2024.

STZ Reiterates FY25 Outlook

Looking ahead to FY25, STZ has projected net sales growth in the range of 4% to 6%, with adjusted earnings expected to be between $13.60 and $13.80 per share. For reference, analysts have forecasted earnings of $13.68 per share.

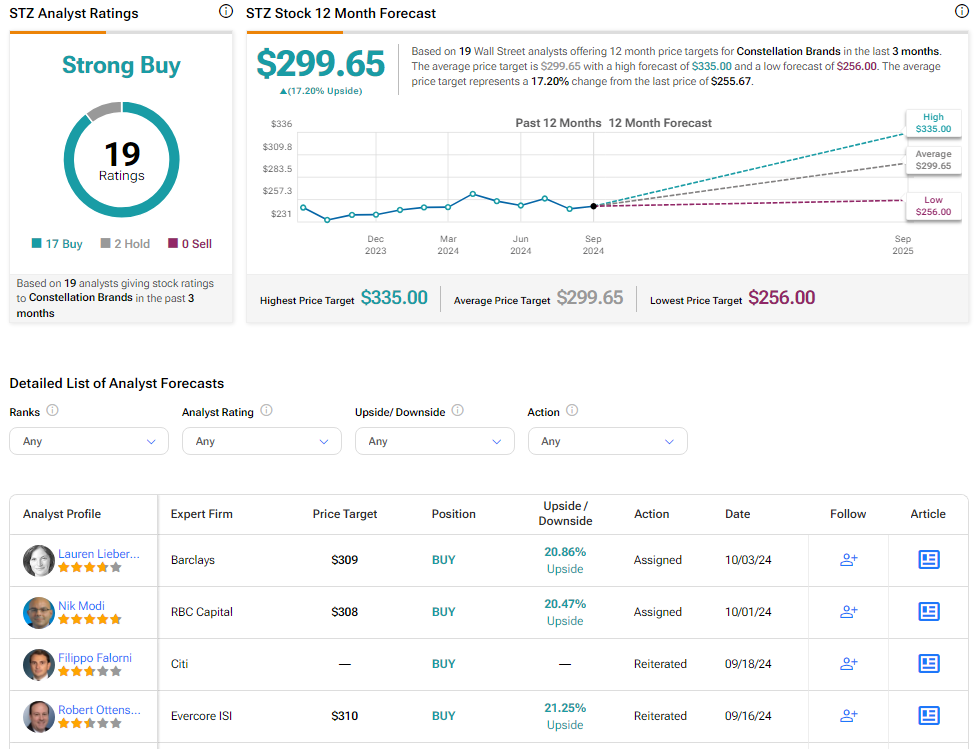

Is Constellation Brands a Good Stock?

Analysts remain bullish about STZ stock, with a Strong Buy consensus rating based on 17 Buys and two Holds. Over the past year, STZ has increased by more than 4%, and the average STZ price target of $299.65 implies an upside potential of 17.2% from current levels. These analyst ratings are likely to change following STZ’s results today.