Shares of Equifax (EFX) rose 5.5% in after-hours trading on Wednesday, thanks to its better-than-expected 2Q earnings. The credit-data company’s adjusted earnings of $1.60 per share topped analysts’ expectations of $1.30. Moreover, quarterly earnings jumped 14% year-over-year, reflecting higher revenues and improved margins.

Equifax 2Q revenues grew 12% year-over-year to $982.8 million and beat Street estimates of $922.5 million. The company said that it recorded double-digit revenue growth in its USIS and Workforce Solutions divisions. However, the weak performance of the International segment remained a drag.

The company’s CEO Mark W. Begor said that “Equifax delivered its second consecutive quarter of strong, double-digit revenue growth and margin expansion, driven by our Workforce Solutions income and employment business which had its strongest results in over 10 years, even with the challenging economic impacts of the coronavirus pandemic in the quarter.”

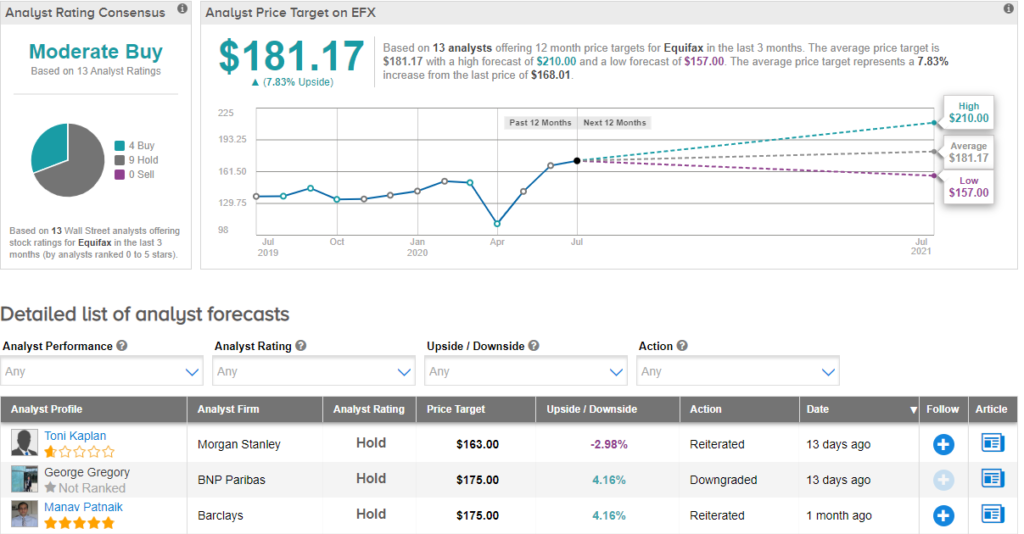

Equifax stock has surged nearly 20% year-to-date and analysts have a cautiously optimistic Moderate Buy stock consensus. The average analyst price target of $181.17 implies upside potential of a modest 7.8% from current levels (See Equifax’s stock analysis on TipRanks).

Related News:

Tesla Gains 4% After-Hours On Upbeat Q2 Earnings

Snap Posts Mixed Q2 Results, but This Analyst Remains Bullish

Check Point Rises 4.5% in Pre-Market On 2Q Earnings Beat