In what may be one of the most unlikely scenarios around, the Screen Actors Guild is now considering a strike of its own, yet most streaming stocks are up following the news. While Netflix (NASDAQ:NFLX) is down slightly, streamers from Warner Bros Discovery (NASDAQ:WBD) to Paramount (NASDAQ:PARA) are up. Even players with other irons in the fire, like Disney (NYSE:DIS) and Amazon (NASDAQ:AMZN), saw gains at the time of writing.

There was good news for people who wanted fresh content any time soon, and there was bad as well. The Directors Guild of America established a new—albeit tentative—contract covering the next three years. However, the Writers’Guild of America—which only recently went on strike itself—held out. Now, the Screen Actors Guild is set to go on strike itself if no contract is reached by June 30. Such a move would hit streaming services doubly hard; the Writers Guild strike was bad enough, but with the Screen Actors Guild involved too, that’s going to trigger a broad wave of shutdowns throughout Hollywood.

The issues behind the potential actors’ strike are roughly the same as the writers’ strike; issues of pay and benefits, issues of royalties, and so on. But for the studios, the strikes are a mixed blessing. While the opportunity to get rid of unprofitable deals with the convenient excuse of strikes is now at hand, streaming services depend on new content to draw new viewers and keep the old ones. There are options for the studios, but many of these—international productions or unscripted reality shows—can have a significant impact on profitability.

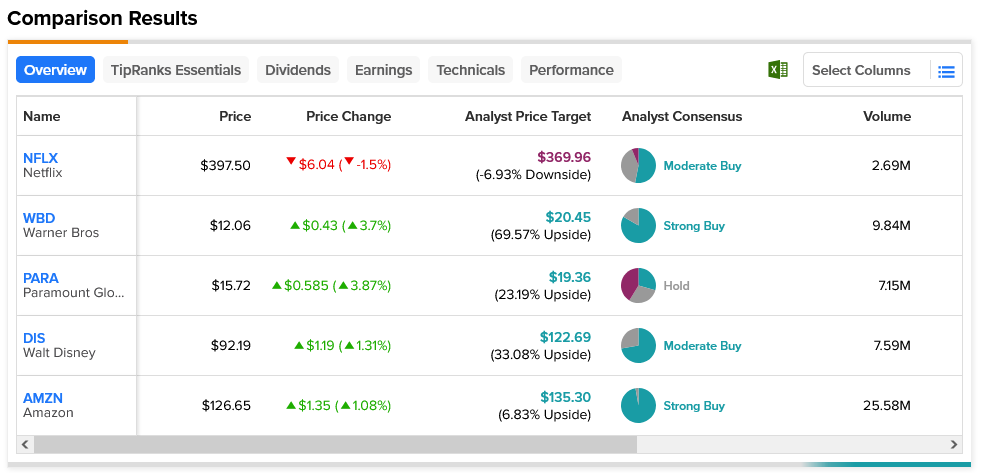

Netflix is the hardest hit streaming stock from this news. It’s considered a Moderate Buy, but it comes with 6.93% downside risk thanks to its average price target of $369.96. Meanwhile, Warner proves the biggest winner here. It was up second-most on the news, it’s considered a Strong Buy, and its $20.45 average price target gives it 69.57% upside potential.