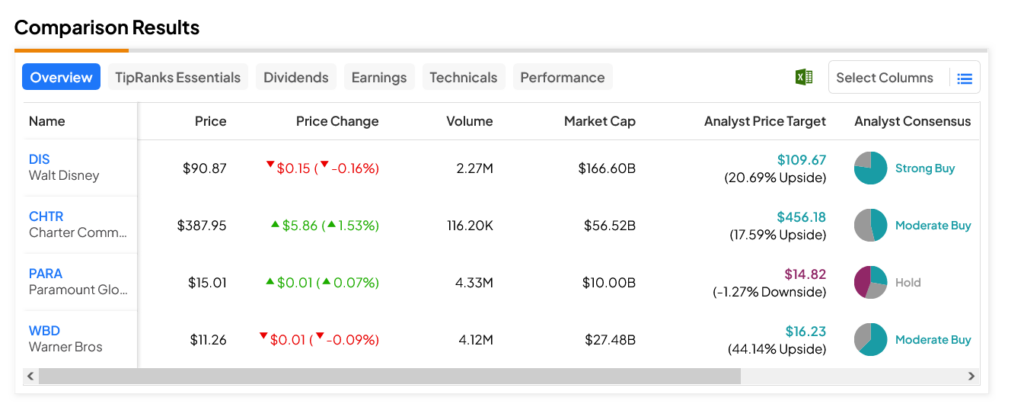

When streaming video started up a few years back, its promise was tantalizing. It offered a way to provide everything in one place. But then, problems started to emerge. Instead of studios licensing out their old content to streaming platforms, studios started to want in on the action themselves. That spawned a fragmented market, which is now being addressed by the concept of the streaming bundle and leading to a lot of confusion in the field. Some streamers are up; Charter Communications (NASDAQ:CHTR) is up over 1.5%, while Paramount (NASDAQ:PARA) is up fractionally. Meanwhile, Disney (NYSE:DIS) and Warner Bros Discovery (NASDAQ:WBD) are down slightly in Tuesday morning’s trading.

The streaming bundle is a comparatively new phenomenon. Advanced by Disney and its Hulu operations and a potential deal between Warner and Paramount, it basically takes two or more streaming services and puts them under one roof. One subscription, one group of content. It’s not the universal, one-touch solution many had hoped for, but for others, there’s a world of difference between paying huge amounts for cable and paying much less for a streaming bundle. In fact, it was Disney and Charter, in their latest fight over carriage costs, that got the entire media industry thinking twice about the bundle.

A Changing Landscape

Streaming as it was originally meant to be may have fallen apart, but its latest incarnation, the bundle, seems to be close. We know that streaming reached its peak not so long ago, and then the ad-supported tiers started kicking in, password sharing was throttled to near-nonexistence, and prices are on the rise as companies look to recoup their costs for all that content they made. So offering bundles—which look like a better value to cash-strapped consumers—can mean a lot of difference in the field.

Which Streaming Stocks are a Good Buy Right Now?

Turning to Wall Street, PARA stock is the laggard in the field, as this Hold-rated stock offers 1.27% downside risk on its average price target of $14.82 per share. Meanwhile, WBD stock is the leader, as this Moderate Buy-rated stock and its $16.23 average price target offer investors a 44.14% upside potential.