Stifel increased the price target on EPAM Systems’ stock to $357 (20% upside potential) from $275 and reiterated a Buy rating after the software engineering and IT consulting services provider reported strong 2Q results.

Stifel analyst David Grossman noted that EPAM Systems (EPAM) “outperformed” 2Q outlook and consensus on better-than-expected demand trends. Grossman stated that “the firm continues to model normalized growth of 20% and margin growth of 16%-17% next year, which should be achievable in an improving economic environment.”

The analyst further added that “he continues to view the stock as a best in class asset that should be a net beneficiary of the current pandemic and continue to grow well in excess of most of its peers.”

On August 6, EPAM reported that adjusted EPS grew 14.1% to $1.46 year-on-year, beating analysts’ expectations of $1.21. Revenues increased 14.6% to $632.4 million year-over-year, surpassing Street estimates of $597.3 million. Ongoing digital transformation and sustained focus on product development and customer engagement are key catalysts for the stock.

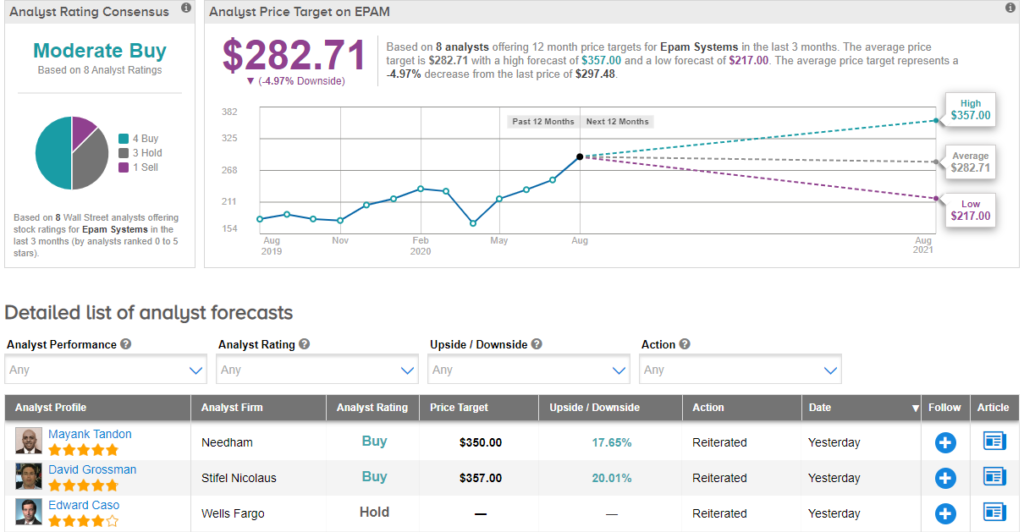

Needham analyst Mayank Tandon also lifted the price target on EPAM to $350 (17.7% upside potential) from $265.

Overall, EPAM has a Moderate Buy analyst consensus. Following the stock’s 40% rally year-to-date, the average price target of $282.71 implies a downside potential of 5%. (See EPAM stock analysis on TipRanks).

Related News:

Etsy Crushes 2Q Revenue Expectations; Roth Raises Stock To Buy

Roku Tops 2Q Estimates But Cautions About Ad Outlook

Zynga Rises On Record 2Q Revenues Fueled By Digital Gaming Demand