Steel producing company Steel Dynamics, Inc.(STLD) recently revealed that it has entered into a definitive agreement to acquire a minority stake of 45% in New Process Steel. The financial terms of the deal have been kept under wraps.

Maximize Your Portfolio with Data Driven Insights:

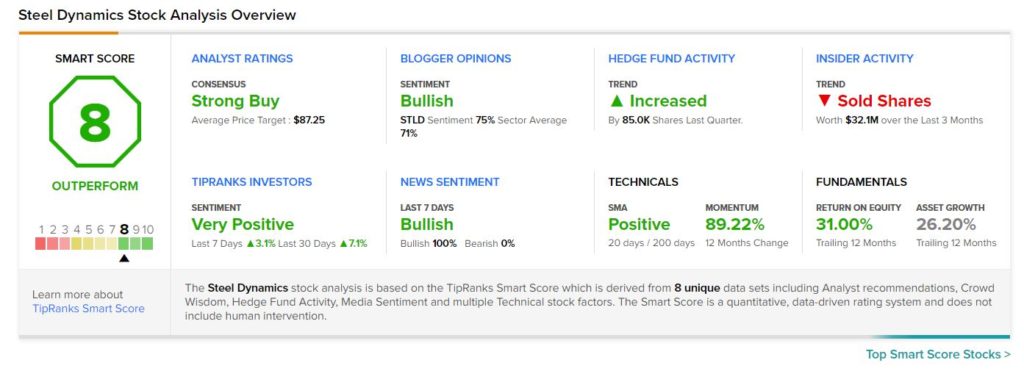

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

New Process Steel is a leading metals products manufacturer and supply chain solutions provider in the country.

Following the news, shares of the company appreciated marginally to close at $62 on Friday.

The CEO of Steel Dynamics, Mark D. Millett, said, “This minority equity interest enables us to grow our exposure to value-added manufacturing opportunities, while continuing to serve our other long-standing flat roll steel customer needs.” (See Steel Dynamics stock chart on TipRanks)

See Top Smart Score Stocks on TipRanks >>

Recently, Goldman Sachs analyst Emily Chieng reiterated a Buy rating on the stock. The analyst, however, lowered the price target from $87 to $72, which implies upside potential of 16.4% from current levels.

Consensus among analysts is a Strong Buy based on 4 unanimous Buys. The average Steel Dynamics price target of $87.25 implies upside potential of 41% from current levels.

Steel Dynamics scores an 8 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. Shares have gained 86.8% over the past year.

Related News:

Citigroup Q3 Results Beat Street Expectations

Domino’s Pizza Posts Mixed Q3 Results

Morgan Stanley Gains 2.5% on Strong Q3 Results