Disney (NYSE:DIS) voters must have taken Ludwig Von Drake seriously because his animated entreaties to vote the current Disney board of directors back in seem to have worked. Despite shareholders apparently getting exactly what they wished for, though, the entertainment giant’s shares are down almost 2.5% in Wednesday afternoon’s trading.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The proxy meeting concluded with a solid vote for the status quo; Disney’s legal head, Horacio Gutierrez, revealed that the “…full Disney slate has been elected by a substantial margin over the Trian group nominees and the Blackwells group nominees.”

This decision was not taken well by defeated candidate Nelson Peltz, who offered a statement following his defeat. Peltz noted that it was “undeniable that the shareholders have suffered over the last few years as the stock dropped from $200 per share.” Peltz did note that the last few months have been “great for the stock…” but also noted that the “long-term track record remains disappointing.”

A Buyer Lost

The move comes with consequences for Disney; it just lost a buyer. No less than Tesla (NASDAQ:TSLA) CEO Elon Musk made it clear that if Peltz were elected to the Disney board, he would have bought Disney shares. Just how many shares is unclear, as is the size of Disney’s theoretical loss, but that might have contributed to the losses we saw today. Some declared this an attempt at “market manipulation,” but given that shares are in open decline after the “successful” proxy vote, that notion can be disputed.

What Is the Future Price of Disney Stock?

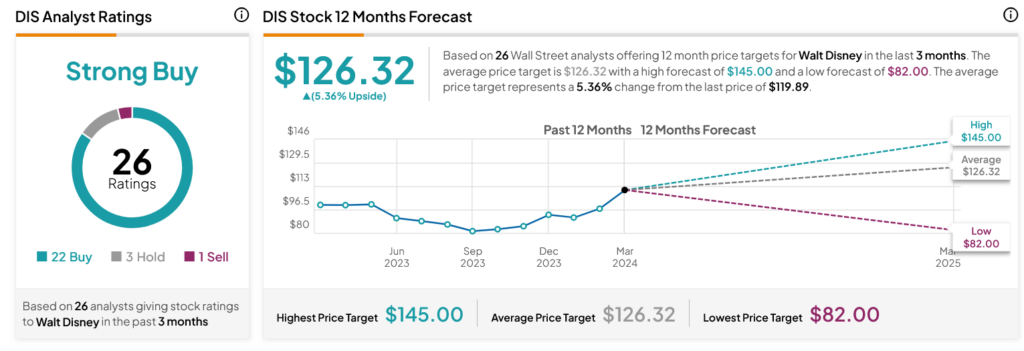

Turning to Wall Street, analysts have a Strong Buy consensus rating on DIS stock based on 22 Buys, three Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 21.27% rally in its share price over the past year, the average DIS price target of $126.32 per share implies 5.36% upside potential.