Shares of State Street Corporation (STT) rose 1.3% in Monday’s trading session after the CFO of the American financial services and bank holding company, Eric Aboaf, said that the company expected its Q2 fee-based income to increase in the range of 4-5% from 2-3% anticipated earlier.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Strong performance of equity markets seems to be backing the company’s upbeat expectations. Notably, the S&P 500 Index has rallied about 7.1% so far this quarter. This is likely to result in higher servicing and management fees.

The servicing fee is now expected to grow by 10% year-over-year. Excluding notable items, expenses are anticipated to increase by 3%, majorly due to currency translation. (See State Street stock analysis on TipRanks)

The CEO of State Street Institutional Services, Francisco Aristeguieta, said that the adoption of a more integrated business model had resulted in the strong performance of the company’s new and core businesses.

Last month, Deutsche Bank analyst Brian Bedell reiterated a Buy rating on the stock and raised the price target from $98 to $105. The analyst’s price target implies 23.84% upside potential.

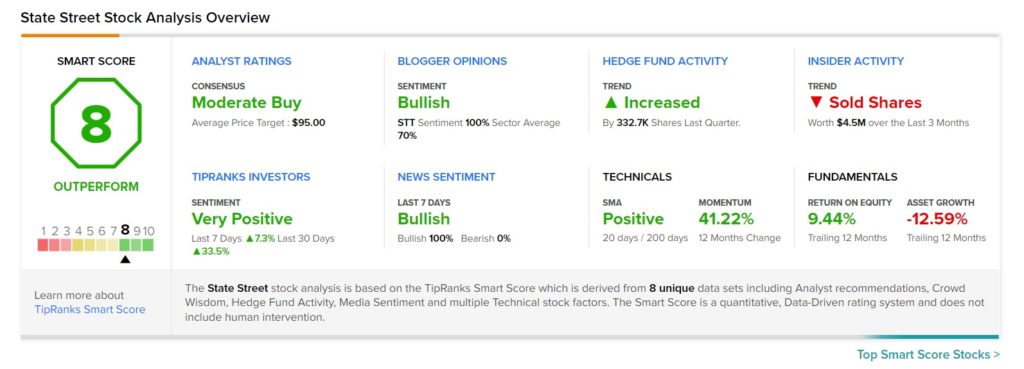

Consensus among analysts is a Moderate Buy based on 4 Buys and 3 Holds. The average analyst State Street price target of $95 implies 12.04% upside potential from current levels. Shares have jumped 4.8% over the past six months.

According to TipRanks’ Smart Score system, State Street gets 8 out of 10, which indicates that the stock has the potential to outperform market expectations.

Related News:

PPL Corp Divests U.K. Utility Business; Plans to Reduce Debt with Proceeds

BlackRock Approved to Start First Wholly Owned Mutual Fund Business in China: Report

California Water Service Arm to Acquire Assets of HOH Utilities Company; Shares Rise 1.7%