Starbucks (SBUX) stock slipped 4.1% in after-hours trading yesterday on dismal preliminary results and suspended guidance. The American coffee chain missed both earnings per share (EPS) and revenue expectations for the fourth quarter of Fiscal 2024 and suspended the outlook for Fiscal 2025. The company is set to release its final Q4 and full-year 2024 results after the market closes on October 30.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Starbucks’ new CEO Brian Niccol has been dealing with persistently declining sales and slower footfall at its coffee shops since the beginning of this year. The company has revised its guidance twice in 2024 owing to macro challenges and intense competition that has consistently hurt its sales, especially in China. Year-to-date, SBUX shares have gained merely 2.8%, while the broader S&P 500 Index (SPX) has gained over 22%.

Q4 Preliminary Results Fail to Impress

For the September quarter, Starbucks reported preliminary adjusted EPS of $0.80, much lower than the consensus of $1.04. Similarly, revenues of $9.1 billion missed the consensus of $9.37 billion. In the prior year period, Starbucks posted adjusted EPS of $1.06 on revenues of $9.37 billion.

Furthermore, comparable store sales fell 7% year-over-year, including a 6% fall in U.S. comparable store sales and a 10% decline in comparable transactions. At the same time, the average ticket size in the U.S. rose 4% compared to Q4 FY23. The CEO explained that the company’s expanded product offerings and frequent in-app promotions did not garner much enthusiasm, resulting in slower-than-expected traffic in the U.S.

Meanwhile, comparable store sales in China collapsed 14% year over year, coupled with a 6% fall in comparable transactions and an 8% fall in the average ticket.

Fiscal 2024 Results and Guidance Withdrawal

For FY24, Starbucks sales increased 1% to $36.2 billion while comparable store sales fell 2%, and adjusted EPS declined 6% to $3.31.

The company added that owing to the CEO transition, it is suspending guidance for the full-year Fiscal 2025. The company believes that this will give enough time to the new CEO to understand and identify the areas of improvement as well as plan a strategy to solidify the business. Under its “Back to Starbucks” plan, the company will focus on all customers, not just its loyalty program members. Starbucks said that it will announce key strategies to turnaround the business at its official Q4 results conference call.

Meanwhile, Starbucks’ board approved a 7% jump in quarterly cash dividend to $0.61 per share from $0.57 per share. The revised dividend will be effective from the November dividend payment.

This is Starbucks’ 14th consecutive dividend increase, boasting a CAGR (compound annual growth rate) of 20%. The annual dividend now stands at $2.44 per share.

Is SBUX a Good Buy Right Now?

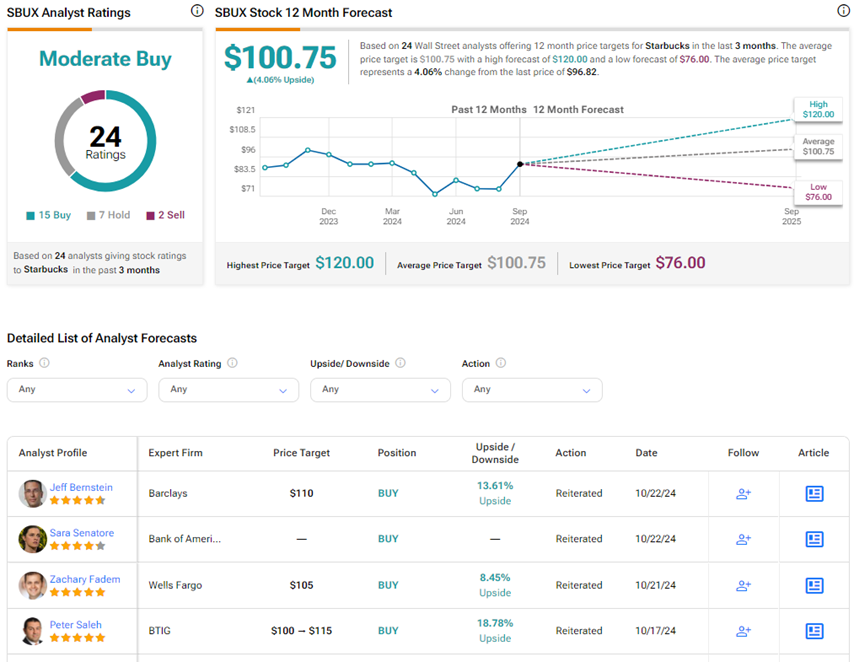

Analysts remain divided on Starbucks stock’s trajectory owing to the ongoing challenges and diminishing sales. On TipRanks, SBUX has a Moderate Buy consensus rating based on 15 Buys, seven Holds, and two Sell ratings. Also, the average Starbucks price target of $100.75 implies 4.1% upside potential from current levels.