On March 16, Shareholders of the American coffee chain Starbucks Corporation (SBUX) applauded the re-assignment of veteran Howard Schultz to the Interim CEO post, with an over 5% jump in stock prices. Schultz will also join the Board of Directors until an effective CEO is found for the company, the announcement said.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Starbucks’ Board decided to retake Schultz after Kevin Johnson said that he was retiring from his CEO post effective April 4. As soon as former CEO Schultz took over the helm of the company today, he decided to temporarily suspend the share buyback program.

Shares are trading down over 1.6% during pre-market trading at the time of writing.

Schultz Takes Over Starbucks as Interim CEO

Schultz is known to be one of the pioneers of change at Starbucks and has led the company thrice earlier in his capacity as CEO. This will be his fourth stint as CEO.

“I am returning to the company to work with all of you to design our next Starbucks — an evolution of our company deep with purpose, where we each have agency and where we work together to create a positive impact in the world,” Schultz wrote in a shareholder letter today.

Schultz announced a temporary halt to the company’s share buyback program so the money can be invested in the company’s operations, employees, and stores to create more long-term value for shareholders.

Starbucks has been facing increased unionization pressures and inflationary concerns, which are hurting its performance. Amid the chaos, Schultz sees the need to reinvigorate the company by creating value for partners, customers, communities, the planet, and shareholders.

The CEO also noted that he along with other company leaders, would travel to various Starbucks offices and plants worldwide to get more insight into employees’ requirements and motivation. This, he said, would lead management to make informed decisions for the company’s bright future.

The company had suspended its share repurchase program earlier in 2020 after its stores were shut due to pandemic-triggered lockdowns. Last year, the company reinstated share buybacks with new authorization for $20 billion in shareholder rewards. Two-thirds of which would be in terms of share repurchases.

Along with its first-quarter results ending January 2, 2022, Starbucks had stated that it repurchased about 31.1 million shares in Q4 and had approximately 17.8 million remaining under the program.

Consensus View

Wall Street analysts are cautiously optimistic about the stock with a Moderate Buy consensus rating based on 13 Buys and ten Holds. The average Starbucks price forecast of $114.05 implies 24.7% upside potential to current levels. Meanwhile, its stock has lost 21.2% year-to-date.

Stock Investors

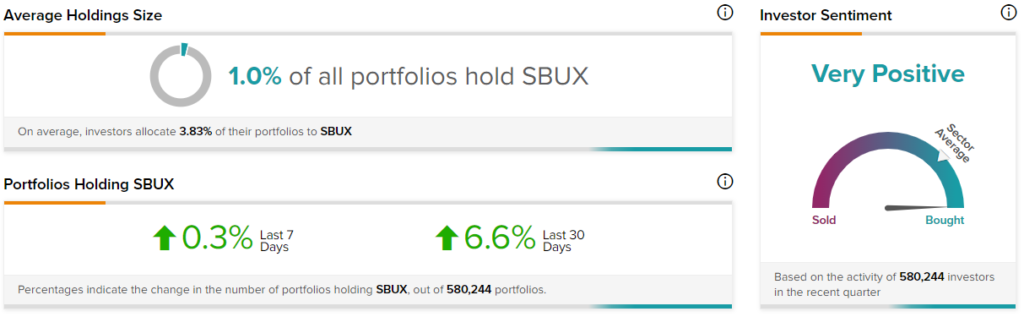

TipRanks’ Stock Investors tool shows that investor sentiment is currently Very Positive on Starbucks, with 6.6% of portfolios tracked by TipRanks increasing their exposure to SBUX stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Tesla Posts Upbeat Q1 Deliveries, On Track to Deliver 1M EVs in 2022

Palantir and Carahsoft Strike Important Partnership

PNC Financial Boosts Shareholder Value