According to a report by Standard Chartered Bank, Solana (SOL-USD) is seen as overvalued compared to Ethereum (ETH-USD) based on key metrics. Nevertheless, the performance of these tokens — along with Bitcoin (BTC-USD) — could depend on the outcome of the upcoming U.S. presidential election.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The bank’s analysts, led by Geoff Kendrick, suggest that a Trump presidency might lead to more favorable crypto regulations and the potential approval of spot-based Solana ETFs, which would likely push SOL to outperform both ETH and BTC. In contrast, a Kamala Harris-led administration might make smaller cryptocurrencies like Solana less attractive and give an edge to Bitcoin and Ethereum.

The report remains bullish on cryptocurrencies overall and predicts strong gains for both ETH and BTC by the end of 2025, regardless of who wins the election. Under Trump, ETH could reach $10,000, while Harris could see it hitting $7,000. In addition, Bitcoin is forecasted to surge to $200,000 under either administration.

Solana Priced for Massive Growth

In contrast, Solana is considered to be priced on the assumption of massive growth. More specifically, the current market price is implying a “100-400x increase in throughput.” As a result, its market cap-to-revenue ratio is significantly higher than Ethereum’s. For Solana to maintain its current valuation, the report says it would need to dominate various crypto sectors like decentralized finance and infrastructure.

Is It Worth Buying Solana Now?

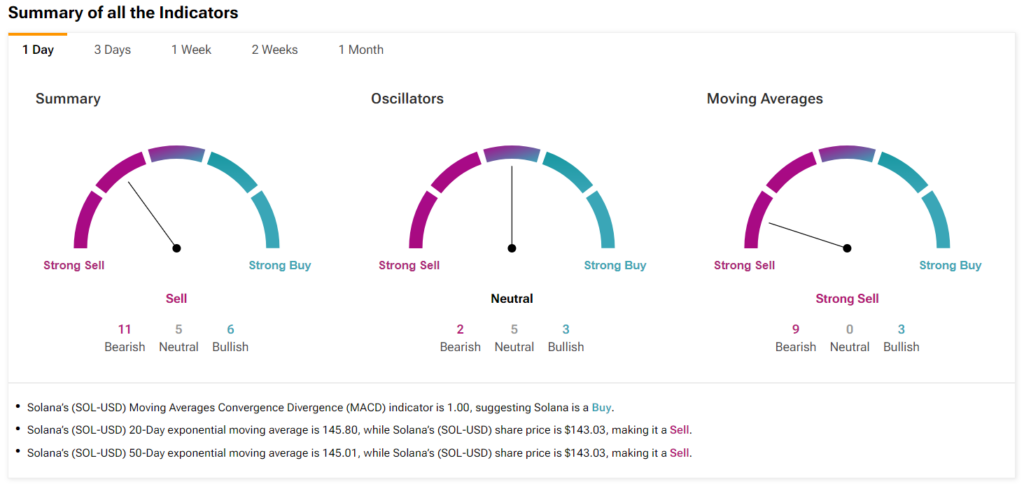

When looking at Solana’s historical performance, it’s easy to see why it seems overvalued compared to Ethereum. While a $10,000 investment in ETH from the beginning of 2019 would be worth over $175k at the time of writing, $10,000 in SOL would be worth a staggering $1.5 million. In addition, it doesn’t help that the summary section of SOL’s technical indicators pictured below points to a bearish outlook in the near term.