SS&C Technologies (SSNC) has boosted its buyout offer for Mainstream Group again. It now plans to acquire Mainstream for A$2.76 a share, implying an enterprise value of A$406 million ($314 million). SS&C Technologies has raised its offer for Mainstream multiple times as it tries to win enough support to complete the transaction.

It announced the deal to acquire Mainstream on April 12, offering a price of A$2 a share for an enterprise value of A$296 million ($225 million). On April 27, it raised the offer to A$2.25 a share. It boosted the offer to A$2.35 a share on April 29. On May 6, the offer jumped to A$2.56 a share, then to A$2.61 per share on May 14. The offer was lifted to A$2.66 per share on May 25.

SS&C Technologies is an American technology company that sells software used in the financial services and healthcare industries. Mainstream is an Australian-listed global provider of investment administration, serving fund managers, dealer groups, and family offices. SS&C counts on the Mainstream acquisition to complement its services.

The transaction is expected to close in the third quarter. The deal requires the approval of Mainstream shareholders and regulatory clearance before it can close. (See SS&C Technologies stock analysis on TipRanks)

Last month, Needham Mayank Tandon reiterated a Buy rating and raised the price target from $80 to $90 on SS&C Technologies stock. The analyst’s new price target implies 21.75% upside potential.

“SSNC posted solid 1Q results, beating consensus estimates on the top and bottom line due to solid performance within the alternatives, Intralinks and software businesses, as well as a boost from the recently acquired Capita Life and Pension business. In addition, SSNC raised FY21 guidance,” noted Tandon.

Consensus among analysts on Wall Street is a Strong Buy based on 7 Buy and 1 Hold ratings. The average analyst price target of $83.29 implies 12.68% upside potential to the current price.

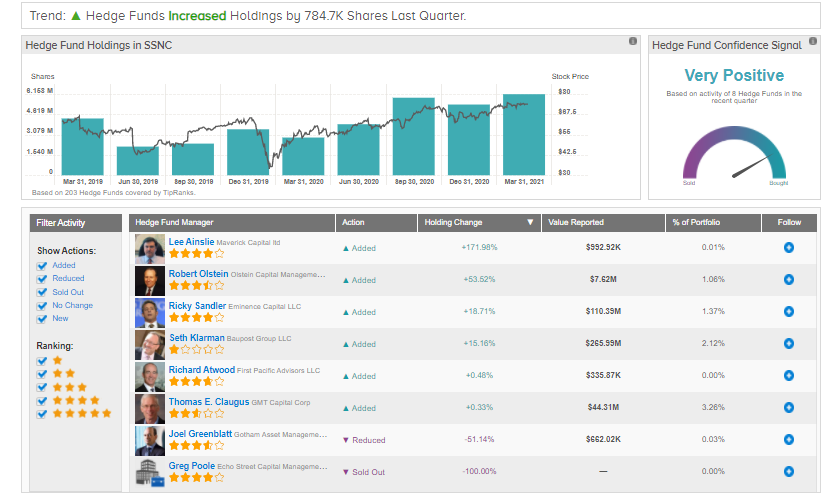

According to TipRanks’ Hedge Fund Trading Activity tool, confidence in SSNC is currently Very Positive. In the last quarter, hedge funds collectively bought an additional 784,700 shares of the company.

Related News:

Apple to Launch Podcast Subscription Service in June – Report

International Paper Sells Turkish Corrugated Packaging Business for €66M

Canopy Growth Posts 38% Revenue Growth in Q4, Miss Estimates; Shares Fall 1%