Shares of Square rose 3.7% in extended trading on Thursday after the mobile payments company’s 3Q earnings of $0.34 per share increased 36% year-over-year and topped the Street estimate of $0.16. Its revenues of $3.03 billion also crushed the consensus estimate of $2.05 billion and spiked 140% year-over-year, led by strong momentum in Cash App.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Square’s (SQ) gross payment volume (GPV) rose 12.4% year-over-year to $31.7 million. The company noted that seller GPV (card payments processed by sellers using Square) trends “were relatively consistent from July to August, followed by a modest improvement in September as regions allowed additional sellers in certain verticals to reopen.” In October, seller GPV grew 8% year-over-year, which improved modestly from the year-ago period.

The company’s mobile payment service Cash App revenue, excluding bitcoin, jumped 174% year-over-year to $435 million, while Cash App gross profit surged 212% year-over-year. Square said “Cash App saw increased engagement as customers adopted multiple products.” The company also noted that in 3Q, “the number of average daily transacting active Cash App customers nearly doubled from the same period last year.” In October, Cash App’s revenue and gross profit growth were strong compared with the year-ago quarter. (See SQ stock analysis on TipRanks)

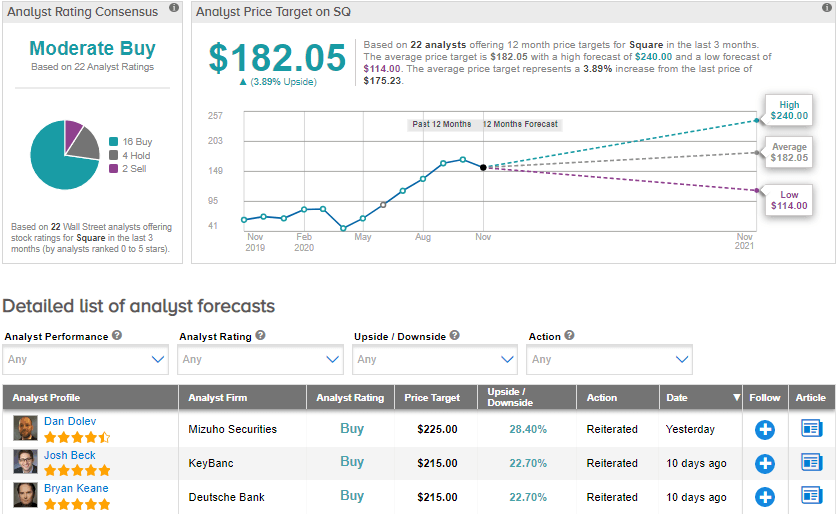

On Nov. 5, Mizuho Securities analyst Dan Dolev maintained a Buy rating and a price target of $225 (28.4% upside potential) on Square stock. The analyst said “Following an unpredictable year, 3Q results were impressive,” marked by strong Cash App gross profits and seller GPV. He added that “SQ’s self-help marketing efforts and superior technology make it shine.” Dolev added: “With seller GPV up +8% in October, an improvement vs. 3Q’s +4%, and accelerating momentum for the Cash App ecosystem, we expect a very positive stock reaction.”

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 16 Buys, 4 Holds, and 2 Sells. The average price target of $182.05 implies upside potential of about 3.9% to current levels, with shares already exploding 180.1% year-to-date.

Related News:

PayPal Shares Fall 4% As 4Q Earnings Outlook Lags Estimates

Facebook Drops 6% on ‘Uncertain’ 2021 Warning; J.P. Morgan Raises PT

Twitter’s Ad Revenues Drive 3Q Sales Beat