Sociedad Quimica Y Minera seeks to raise $1.1 billion from a share sale to finance its $1.9 billion investment plan for the expansion of its lithium, iodine, and nitrate operations in Chile during 2021-2024. Shares declined 1.7% in Thursday’s pre-market trading.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Sociedad Quimica Y Minera’s (SQM) plans to expand its lithium carbonate production from 70,000 MT (metric ton) to 180,000 MT and its lithium hydroxide production from 13,500 MT to 30,000 MT. Chile has access to great natural resources like Salar de Atacama and Caliche ore deposits, the company noted.

As part of the capital raising plan, the company will seek shareholder approval for the issuance of 22.4 million of its series B shares at the its extraordinary meeting scheduled for Jan. 22.

Earlier this week, SQM announced a contract with LG Energy Solution for the supply of lithium for electric car battery cells between 2021-2029.

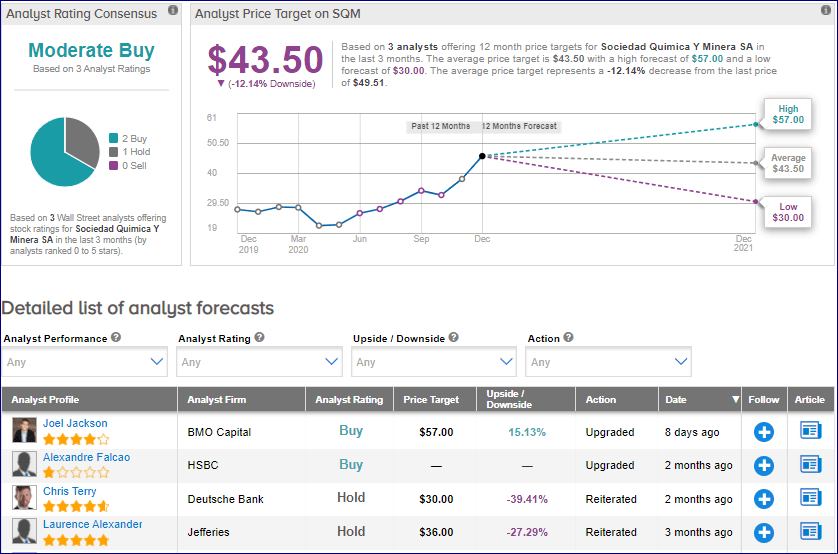

On Dec. 16, BMO Capital analyst Joel Jackson upgraded SQM from Hold to Buy and raised the price target from $39 to $57 (15% upside potential).

Jackson noted that lithium and EV (electric vehicle) stocks have outperformed “strongly” in 2020. Looking ahead, the analyst sees additional upside potential despite the recent rally of EV stocks. (See SQM stock analysis on TipRanks)

From the rest of the Street, the stock scores a cautiously optimistic analyst consensus of a Moderate Buy based on 2 Buys and 1 Hold. The average analyst price target of $43.50 implies downside potential of 12% at current levels.

Related News:

Curaleaf CEO Buys More Voting Shares; Street Sees 21% Upside

Polaris Appoints Interim CEO, CFO Effective Jan. 1; Street Sees 14% Upside

Translate Bio CFO Steps Down For Personal Reasons; Shares Drop 5%