In this piece, I evaluated two streaming stocks, Spotify Technology (NYSE:SPOT) and iHeartMedia (NASDAQ:IHRT), using TipRanks’ comparison tool to see which is better. A closer look suggests bearish views for both, although a winner still emerges from this pessimistic pairing.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Spotify Technology is the most popular audio streaming subscription service in the world, serving over 602 million users in more than 180 markets. iHeartMedia claims to reach 90% of Americans every month with its media and entertainment services. The company touts itself as the number one podcast publisher in downloads, unique listeners, revenue, and earnings and owns over 860 full-power AM and FM radio stations in the U.S.

Shares of Spotify are up 44% year-to-date and 114% over the last year, while iHeartMedia stock has plunged 20% year-to-date and 63% over the last 12 months.

With such a dramatic difference in their share-price performances, a closer look is needed to determine the reasons for that difference and whether it’s warranted. Neither company is profitable, so we’ll compare their price-to-sales (P/S) ratios to gauge their valuations against each other and against that of their industry. For comparison, the U.S. media industry is trading at a P/S of 1.2 versus the three-year average of 1.5.

Spotify Technology (NYSE:SPOT)

At a P/S of 3.6, Spotify is trading at a steep premium to the media industry and roughly in line with its mean P/S since April 2019. While some premium may be warranted because Spotify falls on the newer streaming and podcasting side of the media industry, the company has never been profitable on an annual basis. Thus, a bearish view seems appropriate.

Investors have excitedly bid up Spotify shares after the last earnings report on February 6, even though the company missed revenue expectations. The streaming company reported an adjusted loss of 39 cents per share on $3.95 billion in revenue versus the consensus of 40 cents per share in losses on $4.03 billion in revenue.

Despite the revenue miss, it’s easy to see why the Street was so enthused about Spotify’s latest earnings report. Notably, the company grew its user count by 23% year-over-year to surpass 600 million monthly active users at the end of 2023. Spotify also grew its paying subscriber count by 15% year-over-year to 236 million.

Additionally, management expects to be profitable in the first quarter. However, in all its years of business and user growth, Spotify has never posted a full-year net profit because licensing costs eat away at its income. In all of 2023, the company paid over US$9 billion to music labels and publishers.

Meanwhile, Spotify’s total revenue for the year was €13.2 billion (US$14.3 billion). As such, it’s worth questioning whether the company’s business model will ever allow it to be consistently profitable.

In fact, the company even slashed its workforce three times in 2023, including a 17% cut in December — the largest of the three, announced after posting its first profitable quarter since 2021. As a result, I just can’t in good conscience recommend owning Spotify shares, especially after the year-to-date rally.

What Is the Price Target for SPOT Stock?

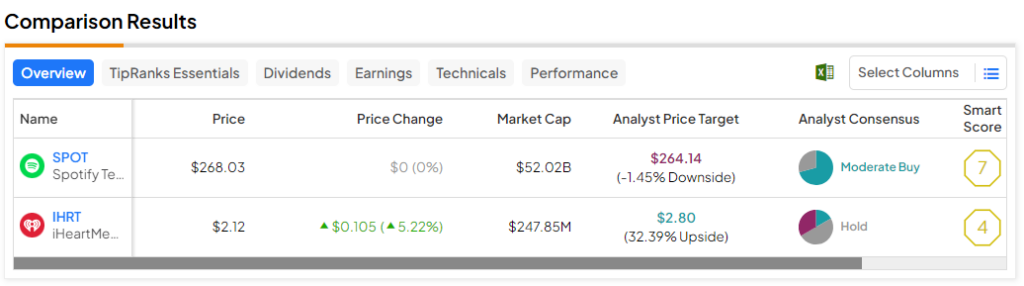

Spotify Technology has a Moderate Buy consensus rating based on 17 Buys, seven Holds, and zero Sell ratings assigned over the last three months. At $264.14, the average Spotify Technology stock price target implies downside potential of 1.45%.

iHeartMedia (NASDAQ:IHRT)

At a P/S of 0.09, iHeartMedia is trading at a deeply depressed valuation versus the broader media industry, although its mean P/S since August 2019 is still only 0.5. However, iHeartMedia is even less profitable than Spotify, and it’s carrying a significant amount of debt on its balance sheet, making a bearish view seem appropriate.

On an annual basis, the company’s net income margins plunged to -29.4% in 2023, down from -6.8% in 2022 and -4.5% in 2021. Meanwhile, Spotify’s net income margins hovered around -4% in 2022 and 2023 after worsening from -0.4% in 2021.

Believe it or not, as recently as January, several analysts have been expecting iHeartMedia to post its final loss in 2023 and begin earning its first profit of $34 million in 2024. However, to accomplish that, the company would have to put up an average annual growth rate of 97%, which looks impossible, given its track record.

In fact, iHeartMedia management called 2024 a “recovery year in which the company returns to growth mode” in their commentary along the fourth-quarter earnings release on February 29. This suggests that management isn’t even looking for a profit this year.

Finally, iHeartMedia has a long way to go before it can dig out from the $5.7 billion in net debt it had on its balance sheet at the end of 2023, especially given its lack of profitability.

What Is the Price Target for IHRT Stock?

iHeartMedia has a Hold consensus rating based on one Buy, three Holds, and two Sell ratings assigned over the last three months. At $2.80, the average iHeartMedia stock price target implies upside potential of 32.7%.

Conclusion: Bearish on SPOT and IHRT

Unfortunately, true to the title of the 1979 song Video Killed the Radio Star, streaming audio companies like Spotify and iHeartMedia can’t seem to turn a profit consistently. With Spotify, there is at least a possibility of that happening, but it remains a show-me story for now.

On the other hand, iHeartMedia appears to have no hope of turning a profit anytime soon. Aside from its more general issues, the company is also saddled with hundreds of radio stations in addition to its podcasting business. As someone who briefly worked in radio broadcasting decades ago, I can say that radio was already dying then, so from a secular standpoint, radio stations just aren’t a great industry to be in.

Thus, while both companies receive bearish ratings, Spotify has the edge over iHeartMedia, albeit ever so slightly.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue