Spotify’s (SPOT) stock surged over 6% in regular trading after the music streaming giant announced strong third-quarter earnings that exceeded expectations across key metrics. Total revenue climbed 19% year-over-year to €4 billion. While this fell short of analysts’ forecast of €4.29 billion, the strong year-over-year growth still reflects Spotify’s solid momentum. This growth was fueled by impressive growth in both Monthly Active Users (MAUs) and Premium Subscribers. CEO Daniel Ek expressed confidence in the company’s momentum, stating, “We’re where we set out to be—if not a little further—and on a steady path toward achieving our long-term goals.”

SPOT’s EPS and Revenue Growth Show Strong Momentum

Spotify delivered a solid Earnings Per Share (EPS) in Q3, coming in at €1.54. However, this fell short of analysts’ consensus estimate of $1.80. Despite missing expectations, this EPS achievement was bolstered by a record 31.1% gross margin, exceeding expectations and marking a 473 basis point increase from the prior year. Strategic cost-cutting measures, such as reduced personnel and marketing expenses, were instrumental in driving these results. Operating income hit a high of €454 million, an 11.4% margin, setting Spotify firmly on track for its first full year of operating income profitability.

Spotify’s User Growth and Engagement Expand Globally

The company’s user base continues to grow, with MAUs up 11% year-over-year to 640 million and Premium Subscribers increasing 12% to reach 252 million. Spotify also expanded features like AI DJ for Spanish-speaking markets and rolled out music video availability to 85 new regions, which has enhanced engagement across its global audience.

Spotify’s Q4 Outlook Builds on Strong Q3 Momentum

Spotify’s Q4 guidance indicates confidence in sustained growth across key performance metrics. For the final quarter of 2024, Spotify expects to add roughly 25 million net new MAUs, bringing the total to 665 million, alongside an anticipated 8 million new Premium Subscribers, bringing that total to 260 million. Revenue is forecasted to reach €4.1 billion, with an approximately 350-basis-point headwind due to foreign exchange fluctuations. However, despite these currency impacts, Spotify’s focus on efficiency and revenue diversification is expected to keep growth on track.

The company projects a 31.8% gross margin for Q4, which should be driven by favorable trends across both the Premium and Ad-Supported segments. Spotify attributes this expected margin expansion to its ongoing focus on optimizing costs and expanding revenue streams through music, podcasts, and newly integrated audiobook offerings.

Is SPOT Stock a Good Buy?

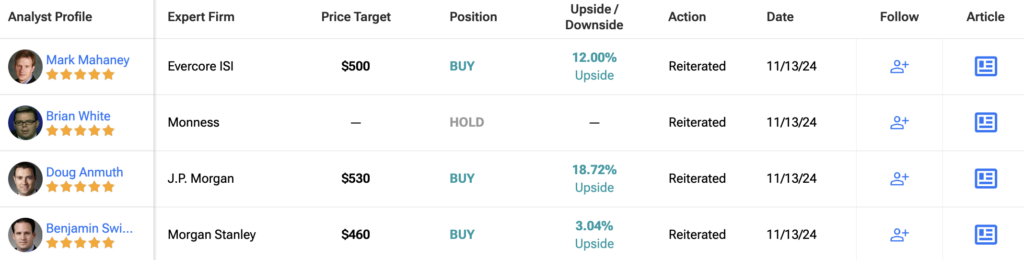

Analysts remain optimistic about SPOT stock, with a Strong Buy consensus rating based on 16 Buys and two Holds. Over the past year, SPOT has surged by more than 160%, and the average SPOT price target of $441.44 implies a downside potential of 1.25% from current levels.

Questions or Comments about the article? Write to editor@tipranks.com