Spirit Airlines (SAVE) stock plunged 63% in Wednesday’s pre-market trading on news that a bankruptcy deal could possibly wipe out shareholders’ wealth. The ongoing negotiations with creditors aim to restructure the company’s existing debt in the bankruptcy court. The news comes as merger talks with Frontier Group Holdings (ULCC) have fallen apart, as the latter is not interested in the deal at this time, the Wall Street Journal reported.

Spirit’s Bankruptcy Process on Fast Track

A Chapter 11 bankruptcy protection would enable Spirit to carry out its regular operations while it negotiates with bondholders. The bankruptcy could reportedly be filed within weeks. Spirit issued a statement last night that noted it was in advanced talks with a supermajority of bondholders to restructure its debt due in 2025 and 2026. The deal would be carried out under a Chapter 11 bankruptcy process and would cancel the company’s existing equity, Spirit added.

Meanwhile, Spirit said that the deal is not expected to impair general unsecured creditors, employees, customers, vendors, suppliers or aircraft lessors, or the holders of its secured debt backed by aircraft.

Spirit Delays Q3 Filing

The ultra-low-cost carrier said that it will be unable to file its earnings report for the September quarter by the required date, amid all the ongoing negotiations. However, it did give a gist of its financial performance.

In Q3 FY24, the adjusted operating margin is estimated to fall by 12% year-over-year owing to high expenses and lower revenues. Also, total operating expenses and adjusted operating expenses are expected to have increased by $46 million and $52 million, respectively, compared to Q3 FY23. Moreover, revenues are estimated to decline by $61 million compared to the prior-year quarter.

Spirit’s efforts, including two merger attempts that failed subsequently, cutting back on growth investments, furloughing pilots, and selling aircraft, have not been enough to address the company’s looming debt problems. Spirit has to service $1.1 billion in bonds maturing next year as well as debt on its credit card transactions that is due in December. Year-to-date, SAVE shares have lost 79.8%.

What Is the Future of Spirit Airlines Stock?

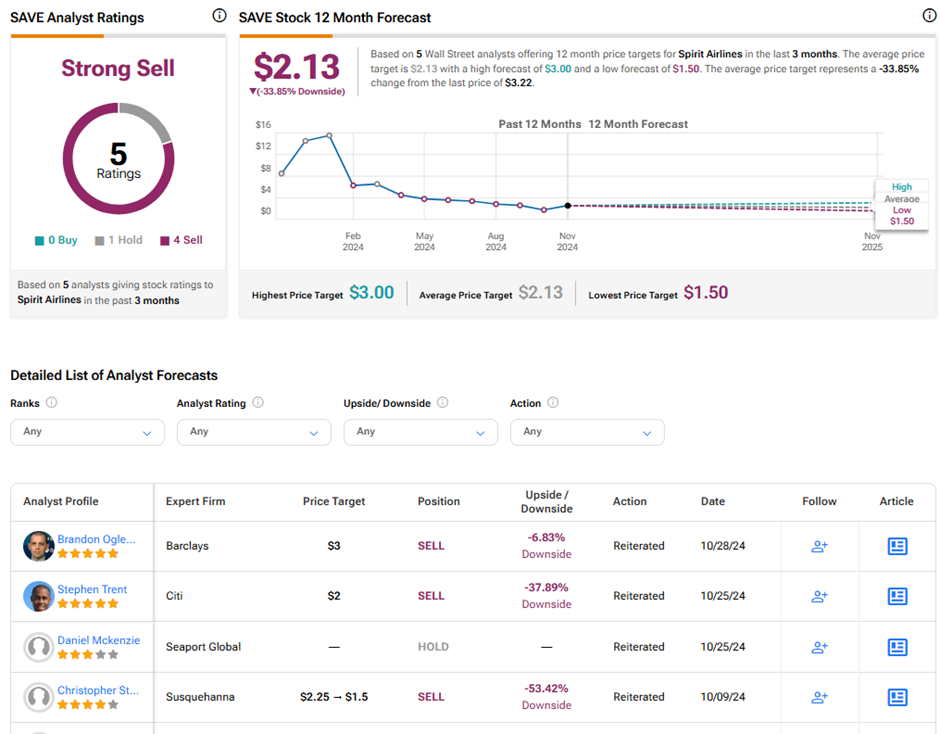

Considering the ongoing challenges and the company’s efforts to effectuate a Chapter 11 bankruptcy, the future of SAVE stock seems in jeopardy. On TipRanks, SAVE stock has a Strong Sell consensus rating based on one Hold and four Sell ratings. Also, the average Spirit Airlines price target of $2.13 implies 33.9% downside potential from current levels.

These ratings could change following the new update given by Spirit Airlines last evening. Analysts could revisit their views on the stock.