Spirit Airlines (NYSE:SAVE) tanked in trading after JetBlue Airways (NASDAQ:JBLU) warned in a company filing that certain conditions to close the merger may not be met before the merger’s termination date on January 28. As a result, the acquisition may terminate on or after January 28.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

JetBlue stated that the company is evaluating its options under the merger agreement. This is another major setback for Spirit Airlines after a U.S. judge recently decided to block the merger.

Following the decision of the U.S. Court, the two companies filed a joint appeal to the U.S. Court of Appeals. At the same time, SAVE issued an upbeat preliminary earnings update, while JetBlue cut several of its routes as it looks for a return to profitability.

Shares of SAVE have been on a see-saw following the flurry of news about the merger, but overall, for the past five trading sessions, shares have plunged by more than 15%.

Is SAVE a Buy or Sell?

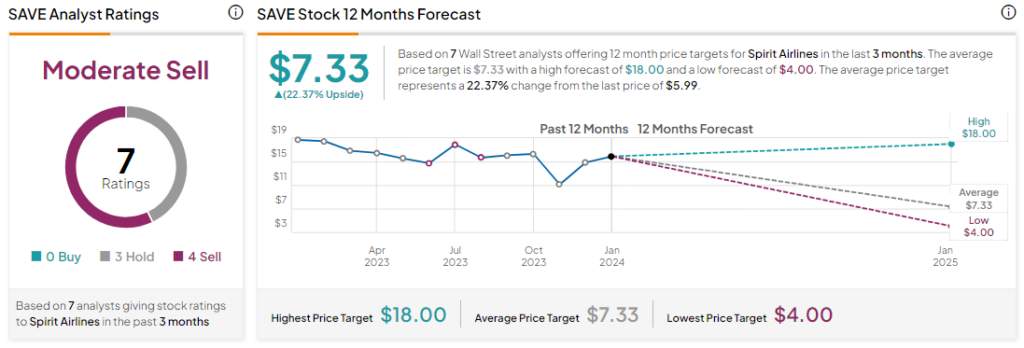

Analysts remain bearish about SAVE stock with a Moderate Sell consensus rating based on three Holds and four Sells. The average SAVE price target of $7.33 implies an upside potential of 22.4% at current levels.