In a surprise twist, airline stock Spirit Airlines (NYSE:SAVE) offered up some new perspective on its upcoming earnings report and denied rumors of restructuring. The combination of factors gave Spirit an incredible tailwind that sent shares soaring up nearly 22% in Friday afternoon’s trading.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Spirit revealed that total revenue was expected to come in at the high end of earlier guidance, thanks in large part to a brisk holiday travel season. A decline in fuel costs meant less strain on revenue, which also opened up a good path to improved earnings. In fact, Spirit reported that it had $1.3 billion in liquidity on hand.

But Trouble May be Ahead

Based on today’s performance so far, Spirit is doing a fine job of fending off the notion that it’s on its last legs after a failed merger with JetBlue (NASDAQ:JBLU) was shot down at the regulatory level. But there are some causes for alarm couched in the whole issue. A New York Times report suggests that some experts are looking for Spirit to file bankruptcy protection, which seems odd in light of how much cash Spirit has on hand based on its 8-K. AlphaSense director of energy and industrials research Xavier Smith declared it was a “…challenging financial picture” for Spirit ahead. This is compounded by the steady decline, albeit with occasional rallies, that Spirit stock has seen since April 2021.

Is SAVE Stock a Good Buy Right Now?

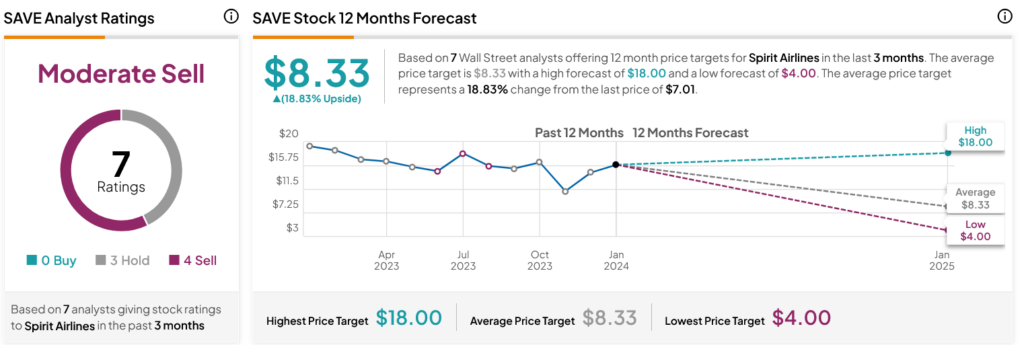

Turning to Wall Street, analysts have a Moderate Sell consensus rating on SAVE stock based on three Holds and four Sells assigned in the past three months, as indicated by the graphic below. After a 62.47% loss in its share price over the past year, the average SAVE price target of $8.33 per share implies 18.83% upside potential.