Spirit Airlines (NYSE:SAVE) announced today that it had reached an agreement with Airbus (OTC:EADSY) to delay all aircraft on order. The company also announced the furloughing of pilots.

The agreement with Airbus will defer aircraft scheduled for delivery from the second quarter of next year through the end of 2026 to the period between 2030 and 2031. Additionally, the airline specified that these deferrals will not include the direct-lease aircraft scheduled for delivery next year—one each in the second and third quarter of 2025, respectively.

Spirit has deferred aircraft deliveries to improve its liquidity position by around $340 million over the next two years. The airline has not made any changes to the aircrafts scheduled for delivery by Airbus between 2027 and 2029.

In addition, SAVE announced that it will furlough 260 pilots, effective September 1, 2024. The company’s decision to furlough the pilots is a result of the grounding of its planes due to the manufacturing defect in Pratt & Whitney GTF engines, and the deferral of aircraft deliveries.

In an attempt to further boost its liquidity by $150 million to $200 million, SAVE had recently entered into an agreement with International Aero Engines (an affiliate of Pratt & Whitney). This agreement will ensure monthly compensation for the airline due to its inability to operate multiple aircraft because of engine issues.

Is SAVE Stock a Buy?

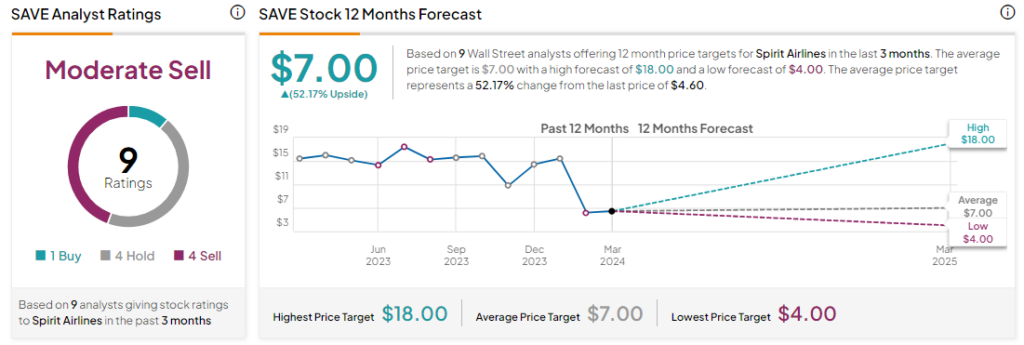

Analysts remain bearish about SAVE stock, with a Moderate Sell consensus rating based on one Buy and four Holds and Sell each. Year-to-date, SAVE stock has tanked by more than 70%, and the average SAVE price target of $7 implies an upside potential of 52.2% at current levels.