Ultra-low-cost airline Spirit Airlines (NYSE:SAVE) ticked higher in pre-market trading after the company refuted a Wall Street Journal report that stated it was exploring different restructuring options. A Reuters report cited an unknown source stating that the company was exploring options to refinance its debt and is not considering restructuring options.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The report quoted this person as saying, “Spirit will continue to take steps to shore up its balance sheet. What we’re looking at is refinancing debt.” Spirit’s spokesperson commented that the airline was “not pursuing nor involved in a statutory restructuring.”

Over the past five trading sessions, SAVE stock has tumbled by more than 60% after a U.S. judge blocked its $3.8 billion merger with JetBlue Airways (JBLU).

Moreover, credit ratings agency Fitch has cautioned that Spirit Airlines faces “significant refinancing risk” over the next year as its $1.1 billion loyalty program debt will be due in September 2025. While Fitch has maintained a B/Negative credit rating on its debt, it urged the airline to develop a near-term plan for generating liquidity, reducing its refinancing risk, and driving profitability to avoid a negative rating action.

Is SAVE Stock a Buy?

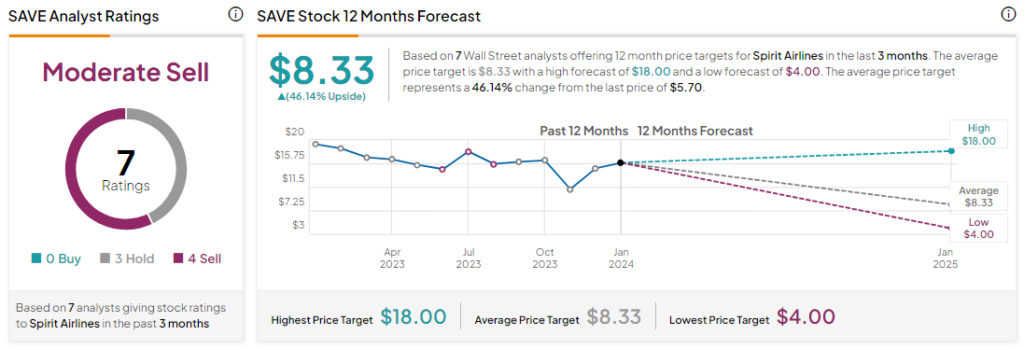

Following the news of the blocking of the merger, top-rated Citi analyst Stephen Trent downgraded SAVE to a Sell from a Hold and lowered the price target to $4 from $13. The analyst’s current price target implies a downside potential of 29.8% at current levels.

Trent stated that while the two airlines (JetBlue and Spirit) could appeal the court ruling, he questioned the rationale for an appeal. The analyst commented, “…it is unclear why JetBlue wouldn’t cut its losses here and recognize that it avoided a risky bid on a highly levered carrier with steep losses.”

Overall, analysts remain bearish about SAVE stock with a Moderate Sell consensus rating based on three Holds and four Sells. The average SAVE price target of $8.33 implies an upside potential of 46.1% at current levels.