Shares of Spirit Airlines (SAVE) nosedived more than 30% in after-hours trading yesterday after the Wall Street Journal reported a potential bankruptcy filing. The low-budget air carrier is in negotiations with bondholders and other creditors to restructure roughly $3.3 billion in debt that is soon to become due. The failed merger attempts with peer JetBlue Airways (JBLU), coupled with industry and company-specific challenges, have forced Spirit to take the drastic step.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Spirit’s Woes Continue to Deepen

Spirit is exploring restructuring its balance sheet in an out-of-court settlement among other things. The company is also in the midst of extending a deadline from its credit card processor for its 2025 loyalty bonds due October 21. Even so, reports state that a Chapter 11 Bankruptcy is the most probable course of remedy under the current circumstances. The timing and details of the bankruptcy filing remain under wraps at the moment.

The airline has refused to share any details on the matter nor speculate on potential outcomes. The company’s CEO Ted Christie stated earlier that navigating the airline efficiently through the process with shareholders’ best interest in mind is the only priority at the moment. Spirit recently reduced its operational footprint and cut routes for November and December. Analysts are also speculating that it plans to slash its capacity by 20% in the fourth quarter as compared to the prior year.

Expectations for the Third Quarter

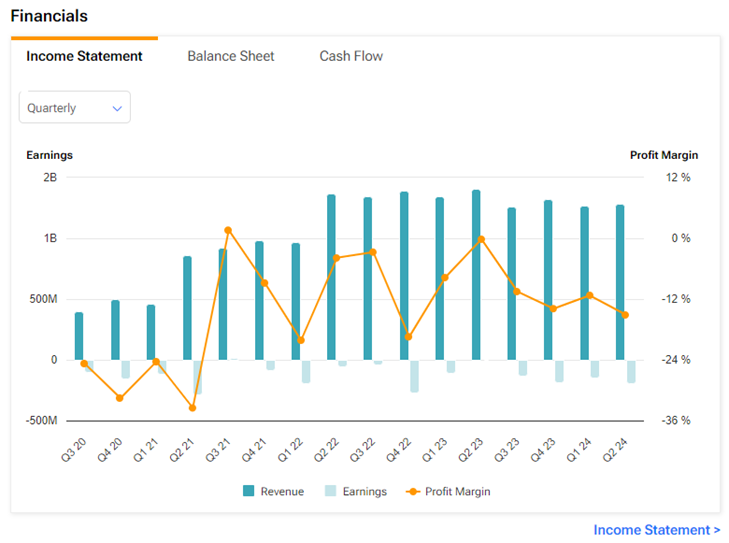

Spirit has already cautioned investors of a higher loss expectation for the third quarter. The carrier cited continued pressure from competitive ticket pricing and oversupply of seats in the domestic market as prime reasons for the elevated loss. The Street expects Spirit Airlines to post an adjusted loss of $2.34 per share on revenue of $1.17 billion.

Spirit has reported losses in five out of the past eight quarters. The airline continues to burn cash with mounting debt servicing charges hanging on its head. At the same time, issues and recalls related to the Pratt & Whitney-geared turbofan engines have aggravated Spirit’s troubles and led to the grounding of several jets.

Is Spirit a Buy or Sell?

Amidst the ongoing challenges, analysts are bearish about Spirit Airlines stock’s trajectory. On TipRanks, SAVE stock has a Strong Sell consensus rating based on one Hold and seven Sell recommendations. Also, the average Spirit Airlines price target of $2.40 implies 7.1% upside potential from current levels. Year-to-date, SAVE shares have lost nearly 86%.