Spirit Airlines (SAVE) and JetBlue Airways (JBLU) are in a tussle over the former’s acquisition by Frontier Group Holdings (ULCC). Spirit stock fell 1.7% on May 19, after it asked shareholders to reject JetBlue’s tender offer. Meanwhile, JetBlue stock rose more than 3.3%.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

In February, ULCC agreed to acquire Spirit in a cash and stock transaction. However, JetBlue showed up with its own buyout offer for Spirit in April as a challenge to Frontier’s offer. Spirit’s board turned down JetBlue’s offer, but JetBlue decided to take the offer straight to Spirit’s shareholders in a hostile takeover bid.

Spirit Tells Shareholders to Reject JetBlue

JetBlue has offered to buy Spirit for $30 per share in cash, valuing the budget airline at $3.3 billion. Spirit shareholders are set to meet June 10 to decide on the Frontier deal. JetBlue has asked the shareholders to tender their shares into its offer and reject rival Frontier’s buyout bid. However, Spirit’s board supports the Frontier deal and has urged shareholders to turn down JetBlue’s offer.

Regulatory Risk and Valuation Underpin Dispute

In urging shareholders to reject the JetBlue offer, the Spirit board argues that it poses a significant regulatory risk that would make closing a deal difficult. JetBlue has countered that even the Frontier deal is subject to regulatory review and that the risk profile is the same.

JBLU has appealed to Spirit shareholders that its offer is superior to that of Frontier. JetBlue has even promised to boost its offer to $33 per share if Spirit shareholders reject the Frontier offer and compel the board to negotiate with it in good faith.

Wall Street’s Take

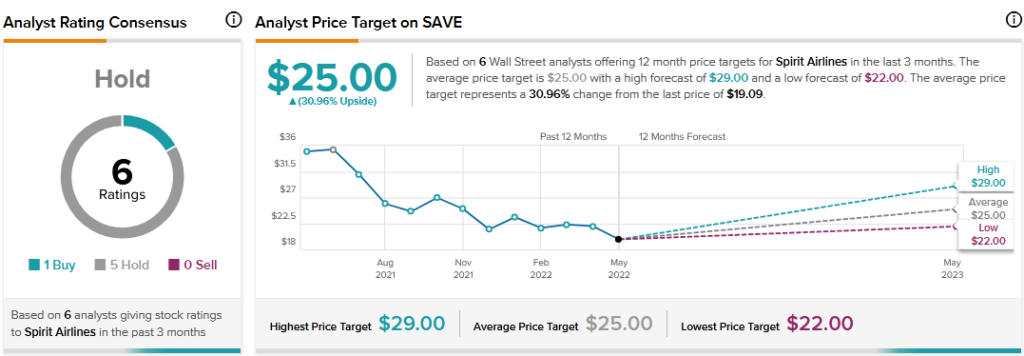

The stock has a Hold consensus rating based on one Buy and five Holds. The average Spirit Airlines price target of $25 implies 31% upside potential to current levels.

Smart Score

According to TipRanks’ Smart Score system, Spirit Airlines gets a five out of 10, which indicates that the stock is likely to perform in line with market averages.

Key Takeaway for Investors

Spirit shareholders will decide which deal they like. For now, Spirit stock offers a merger arbitrage opportunity if either offer succeeds.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Boeing’s 737 MAX Aircraft in Limelight Again

Cathie Wood Tweet Raises Concern as Big Retailers Deal with Excessive Inventories

Why Did Shares of Applied Materials Drop Post Q2 Results?