Shares of commercial aerostructures provider Spirit AeroSystems (NYSE:SPR) are tanking today after its second-quarter net loss per share at $1.46 came in wider than expectations by $0.75. Its topline at $1.37 billion, on the other hand, clocked an 8.7% year-over-year growth and landed past estimates by $60 million.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company’s net loss as a percentage of revenue widened to 15.1% from 9.7% a year ago after the stoppage of work by employees impacted production and deliveries. Subsequently, Spirit has chalked out a four-year contract with its IAM-represented employees and resolved the rework associated with the vertical attach fittings issue on the available Boeing 737 units in Wichita.

As a result of the work stoppage, Spirit’s labor costs are expected to rise by $80 million annually and the full-year deliveries of 737s are now expected to hover between 370 to 390 units. This is also expected to impact its financial performance for 2023.

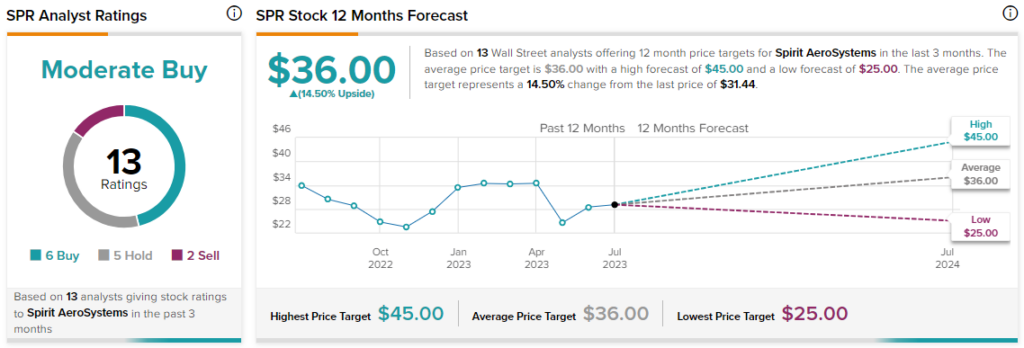

The company’s backlog at the end of the quarter stood at $40.5 billion. Overall, the Street has a $36 consensus price target on Spirit alongside a Moderate Buy consensus rating. Short interest in the stock is now hovering at nearly 7%.

Read full Disclosure