Shares in Spirit AeroSystems (SPR) pulled back 3.3% in Monday’s after-hours trading after revealing that it could breach the financial covenants under its credit agreement in Q4 without an amendment or waiver.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

“Spirit is in communication with its lenders regarding this matter, and intends to work with them expeditiously to obtain appropriate relief from its covenants” the aerostructures manufacturer said.

The warning was sparked by a June 19 letter from Boeing (BA) telling Spirit to substantially reduce its 2020 B737 production plan (applicable to MAX and P-8 shipsets) from 125 to 72 shipsets.

This includes 37 shipsets to be produced and delivered over the balance of the year and 35 shipsets that have already been delivered to Boeing.

Boeing indicated that the reduction is due to COVID-19’s impact and accumulated inventory of Spirit’s B737 products, Spirit revealed.

“The B737 MAX grounding coupled with the COVID-19 pandemic is a challenging, dynamic and evolving situation for Spirit” the company stated, adding that it plans to work with Boeing to manage the B737 production system and supply chain.

Spirit’s business depends, in large part, on sales of components for a single aircraft program, the B737 MAX.

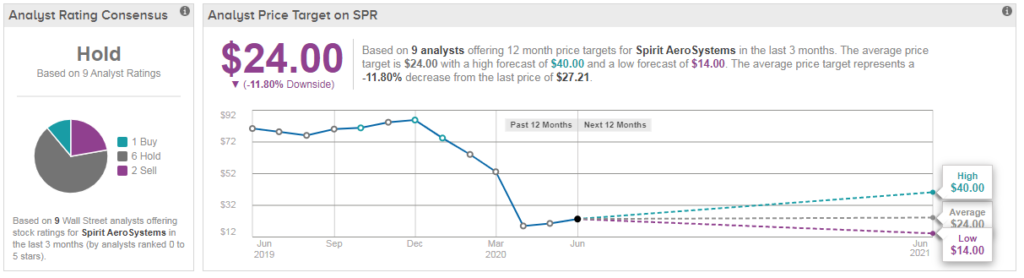

Shares in Spirit have plunged 63% year-to-date, and analysts have a cautious Hold consensus on the stock. This breaks down into 1 recent buy rating, 6 hold ratings and 2 sell ratings.

Meanwhile the average analyst price target of $24 indicates the stock could fall a further 12% in the coming months. (See SPR stock analysis on TipRanks).

“We’re cutting SPR estimates accordingly and would look for better visibility of BA’s MAX delivery ramp before stepping into the stock” wrote Cowen & Co’s Cai Rumohr as he reiterated his Hold rating with a $21 price target. He notes that SPR still expects to close the Asco & Bombardier deals, likely in Q3.

Related News:

Global Airlines Are Set To Lose $84.3 Billion In 2020, IATA Says

United Airlines Secures $5 Billion Loan To Shore Up $17 Billion Liquidity Chest

American Airlines To Upsize Share, Convertible Sale To $2B- Report