Elliott Investment Management and Southwest Airlines (LUV) are engaged in settlement talks that could grant the activist investor significant representation on the airline’s board, according to an exclusive Bloomberg report. While the discussions are confidential, the agreement under consideration would give Elliott significant influence on the board without granting full control.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Southwest’s board size will drop to 12 members once Chairman Gary Kelly steps down next year, suggesting that Elliott would likely secure fewer than six seats. However, the report cautioned that the negotiations are still in their early stages, and there is no guarantee that a deal will be finalized.

Elliott Is Increasingly Putting Pressure on LUV

Over the past few months, Elliott has been increasingly putting pressure on the airline. The activist investor has built up an 11% stake in Southwest and has been pushing for significant leadership changes, including the removal of CEO Bob Jordan. Furthermore, Elliott has criticized the airline’s business strategy and demanded improvements in its operational performance.

However, Southwest has expressed confidence in Jordan, who has been with the company for nearly 40 years. As part of the company’s efforts to improve its profitability, the airline recently outlined a three-year plan targeting $4 billion in earnings before interest and taxes (EBIT) by 2027. In addition, Southwest announced a $2.5 billion stock buyback and a reduction in flights from Atlanta to optimize margins.

Southwest is expected to announce its Q3 results on October 24.

Is LUV a Good Buy Right Now?

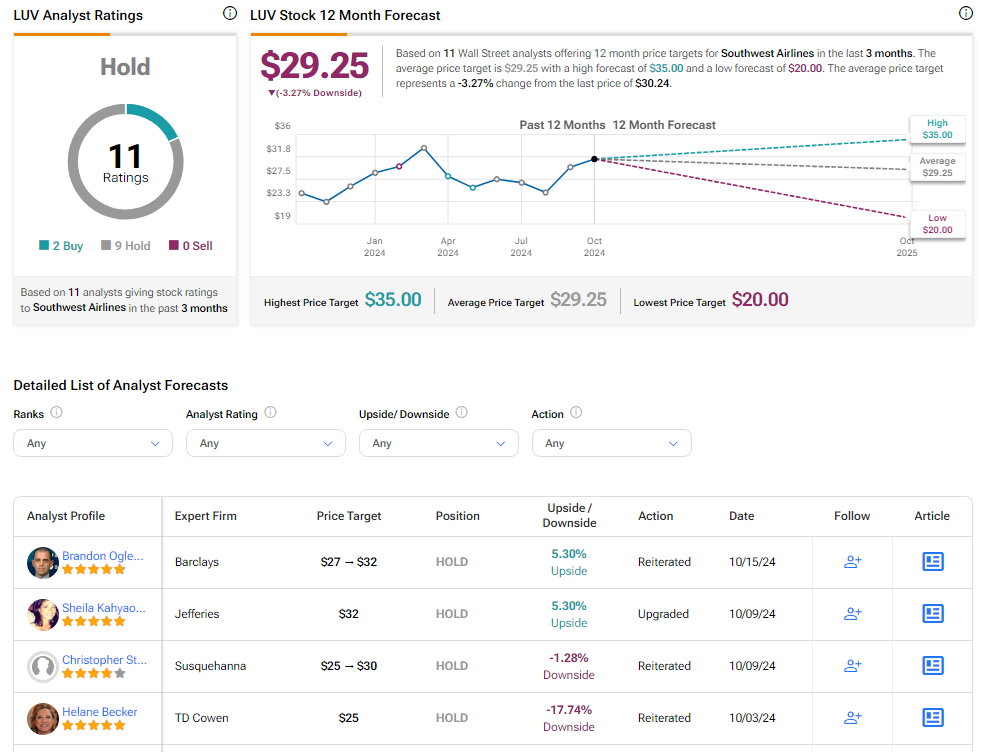

Analysts remain sidelined about LUV stock, with a Hold consensus rating based on two Buys and nine Holds. Over the past year, LUV has surged by more than 20%, and the average LUV price target of $29.25 implies a downside potential of 3.3% from current levels.