Southwestern Energy Company (SWN) revealed that it has completed the acquisition of GEP Haynesville, LLC. The company engages in the exploration, development, and production of natural gas, oil, and natural gas liquids (NGLs).

Shares of Southwestern Energy declined 2.9% on Friday to close at $4.66 per share.

With this deal, Southwestern Energy seeks to build a presence in Haynesville, strengthen inventory, improve key financial measures such as margins, returns and per-share ratios. The buyout is expected to reflect the company’s strength and enhance its presence in the two premier natural gas basins in the US.

Last month, Southwestern Energy closed an offering of $1.15 billion of 4.75% senior notes due 2032 and a $550 million institutional term loan to fund the cash consideration for the acquisition and tender for $300 million of its 2025 senior notes.

Price Target

Last month, RBC Capital analyst Scott Hanold maintained a Buy rating on Southwestern Energy with a price target of $7 (50.2% upside potential).

Based on 3 Buys, 9 Holds and 1 Sell, the stock has a Hold consensus rating. The average Southwestern Energy price target of $6.77 implies 45.3% upside potential from current levels. Shares have gained 52.3% over the past year.

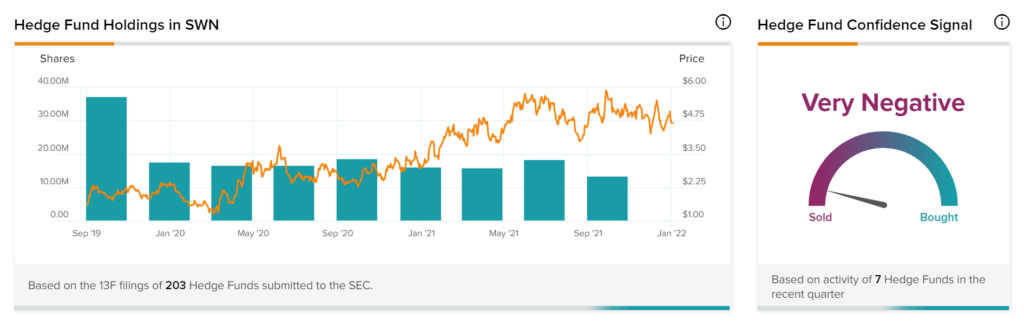

Hedge Fund Trading Activity

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Southwestern Energy is currently Very Negative, as the cumulative change in holdings across all seven hedge funds that were active in the last quarter was a decrease of 5.1 million shares.

Download the mobile app now, available on iOS and Android.

Related News:

Novavax Completes Data Submission to FDA for Emergency Use

Morgan Stanley Agrees to Settle Data Security Lawsuit

Dominion Energy Completes Sale of Questar Pipelines