Southwest Airlines will be adding its services to Chicago’s O’Hare International Airport and Houston’s George Bush Intercontinental Airport in the first half of 2021 as part of its efforts to expand services in these two cities, the company has announced.

Southwest (LUV) will add new services from the O’Hare International Airport in addition to its existing presence at Chicago’s Midway International Airport, which is one of the busiest airports in the carrier’s network.

The expansion of the carrier to the O’Hare airport will help in challenging the dominance of United Airlines and American Airlines in the region.

The carrier is also returning to Houston’s George Bush Intercontinental Airport next year after it pulled back its services in 2005. The new addition should complement Southwest’s substantial operation at the Houston Hobby airport.

Amid a challenging business environment, Southwest has been adding new destinations to drive demand. Last week, the airlines announced that year-round service for Miami and Palm Springs will commence from Nov. 15 and seasonal service to Montrose Regional Airport will start from Dec. 19.

Travel restrictions and rising COVID-19 cases have crushed the airline industry. Airlines have been losing billions of dollars since the pandemic began. Deutsche Bank analyst Michael Linenberg expects the third-quarter revenue for the airline industry to decline 75% Y/Y with passenger revenue down 80%.

However, the analyst maintains a “bullish stance” on the sector and recommends large-cap airlines with the strongest balance sheets, like Delta Air Lines and Southwest Airlines, along with small-caps Alaska Air, Allegiant Travel and SkyWest. He recommends United Airline Holdings and Spirit Airlines for investors who are “seeking names more leveraged to a recovery in air travel demand.” (See LUV stock analysis on TipRanks)

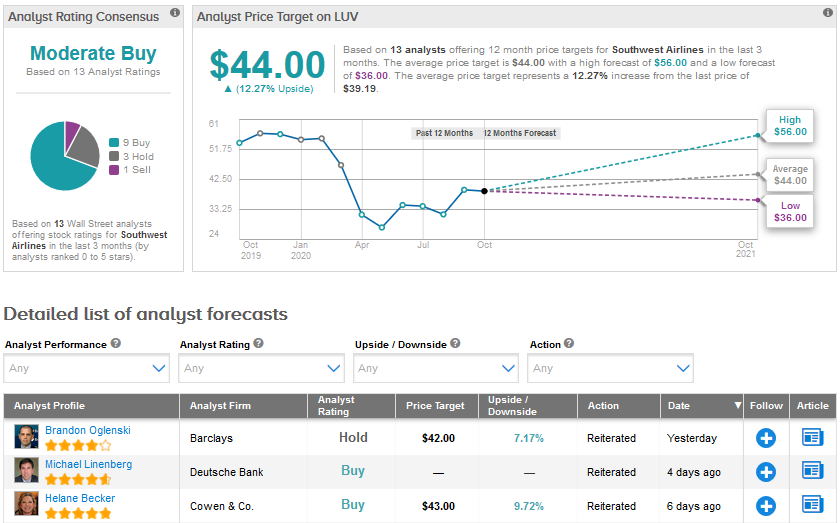

The Street’s cautiously optimistic Moderate Buy consensus for Southwest Airlines is based on 9 Buys versus 3 Holds and 1 Sell. Southwest shares have plunged 27.4% so far this year. The average analyst price target of $44 indicates a potential upside of 12.3% in the months ahead.

Related News:

Air Canada Chops Transit Takeover Price By 74% Due To Covid-19 Crisis

Airbus Jet Deliveries Show Monthly-High In Sept., No New Orders

Daimler, Swiss Re Form Mobility Insurance JV; Goldman Double Upgrades To Buy