Southwest Airlines expects average daily core cash burn of about $17 million in 3Q down from its previous estimate of $20 million. The average daily core cash burn in Aug. was about $19 million. Southwest stock rose about 4% on Wednesday following the news.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

In an investor update, Southwest Airlines (LUV) said that it expects “continued improvements in close-in leisure demand and booking trends.”

The airline industry is among the worst hit by COVID-19 as stay-at-home restrictions and rising virus cases have brought travel demand to an almost complete halt. Southwest expects 3Q capacity to drop between 30% to 35% Y/Y with Oct. capacity estimated to decline 40% to 50% and Nov. capacity plunging between 35% to 40%.

The air carrier experienced modest recovery in close-in leisure passenger demand in Aug. and this trend has continued so far into Sept. Moreover, the company is also seeing modest improvement in leisure bookings, for the remainder of Sept. and for October.

As a result, the air carrier now forecasts operating revenue to fall between 65% to 70% in Sept. compared to a previous forecast of a decline of 65% to 75%. Meanwhile, Oct. operating revenue is expected to be down 65% to 75%.

Currently, Southwest does not intend to use its loyalty program to secure additional financing, the company said. Delta Air Lines, United Airlines and American Airlines recently announced plans to raise debt backed by their loyalty programs. (See LUV stock analysis on TipRanks)

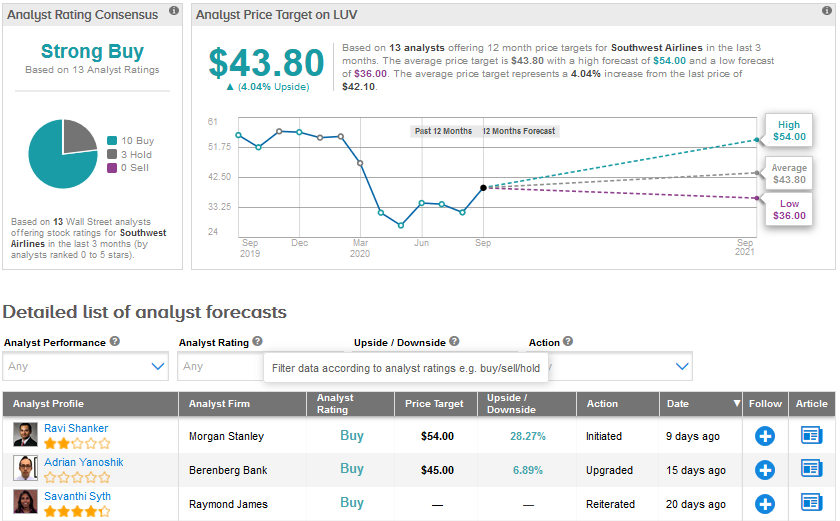

On Sept. 8, Morgan Stanley analyst Ravi Shanker initiated coverage of the stock with a Buy rating and a $54 price target. The analyst is bullish on the timeline for recovery in airline traffic and sees air travel demand returning to pre-COVID levels, on a “run-rate basis,” by late 2021 to early 2022. He added that his stock preference reflects a “barbell approach” with a bias toward low-cost carriers and ultra-low-cost carriers versus the legacy airlines.

The rest of the Street shares Shanker’s bullish outlook. The Strong Buy analyst consensus is based on 10 Buys, 3 Holds and no Sell ratings. The stock has declined about 22% year-to-date with the average analyst price target of $43.80 implying upside potential of 4% in the coming months.

Related News:

Delta Manages To Avoid Furloughs For Flight Attendants, Employees

FedEx Crushes 1Q Estimates; Shares Soar 8.3%

Delta To Raise $6.5B Debt Backed By Frequent-Flyer Program