SoundHound AI (SOUN) is an industry-leading AI-driven voice and conversational intelligence company showing signs of a robust growth trajectory. The stock is up roughly 230% over the past year, and it boasts a debt-free balance sheet, strategic acquisitions, and a promising outlook, including the possibility of achieving profitability by 2025. Despite concerns over its overvaluation, persistent losses, and slowing revenue growth, the company’s unique positioning and partnerships in critical industries present an intriguing investment prospect with potential for considerable returns. SOUN is an attractive investment opportunity offering solid upside potential.

SoundHound’s Acquisition of Amelia Expands its Portfolio

SoundHound AI is a tech firm developing independent voice artificial intelligence (AI) solutions. The company provides solutions to businesses in various sectors, including automotive, customer service, IoT, and TV, to provide top-level conversational experiences for its customers. Its products include the Houndify platform, SoundHound Chat AI, and SoundHound Smart Answering. SoundHound’s voice recognition and conversational speech tech have attracted investment from Nvidia (NVDA), which invested $3.7 million in the company and uses its technology in its Nvidia Drive driver-assistance vehicle system.

The company has made significant strides in expanding its offerings and global reach, including the recent acquisition of Amelia, a top enterprise AI software company. This strategic acquisition extends SoundHound AI’s customer service pillar, introducing healthcare, insurance, financial services, and retail verticals. The merged entities encompass about 200 noteworthy clients, including some of the largest global enterprise brands, top 15 global banks, and Fortune 500 organizations.

SoundHound has also joined forces with Perplexity to enhance its Chat AI capabilities and handle more complex questions. The voice AI firm also partnered with Connex2X, which specializes in connected vehicle products. Its AI tech was integrated into several car brands to enhance their digital assistant capabilities. Additionally, SoundHound recently purchased Allset, a food ordering platform, pushing its capabilities in the voice commerce ecosystem.

Financially, the company expects its combined revenue to exceed $150 million in 2025, with Amelia contributing over $45 million in recurring AI software revenue.

SoundHound’s Recent Financial Results

The company’s second-quarter financial results underpin a solid growth and performance period. Revenue reached $13.5 million, a significant 54% year-over-year increase. The GAAP gross margin hit 63%, while the non-GAAP gross margin reached 67%. The company posted a GAAP net loss of $37.3 million and a non-GAAP net loss of $14.8 million, and the adjusted EBITDA was also negative at $13.8 million. GAAP earnings per share haven’t met expectations at $0.11, missing by $0.2.

However, the cumulative subscriptions and bookings backlog roughly doubled year-over-year to reach $723 million, and the company reported an impressive annual run rate of over 5 billion queries, an increase of approximately 90% year-over-year.

During the quarter, the company converted all preferred equity into class A common stock and prepaid $100 million in debt, saving over $55 million in interest and fees over the loan’s remaining life. At the end of the quarter, the company reported a cash balance of $201 million.

Following the announcement of the Amelia acquisition, management has updated its financial guidance and anticipates exceeding revenue of $80 million for 2024 and expects to surpass $150 million by 2025.

What Is the Price Target for SOUN Stock?

The stock has been trending upward, climbing over 144% year-to-date. It trades near the middle of its 52-week price range of $1.51 – $10.25 while showing positive price momentum by trading above the 20-day (5.07) and 50-day (4.94) moving averages. Based on a P/S ratio of 25.9x, it appears to be trading at a significant premium to the Application Software industry, where the average P/S ratio is 6.8x.

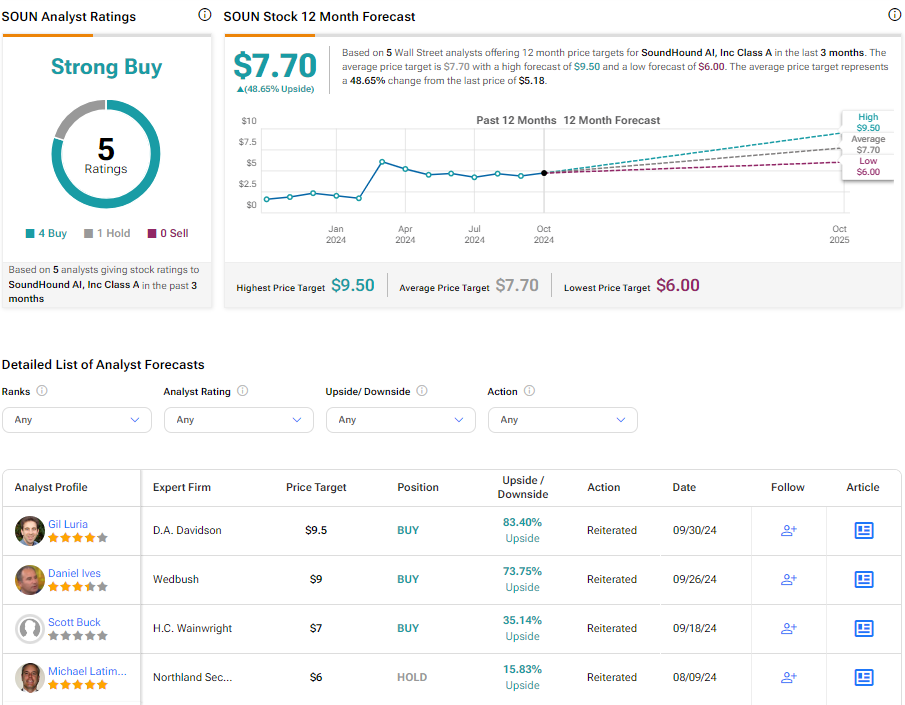

Analysts following the company have mostly been bullish on the stock. Based on five analysts’ most recent recommendations, SoundHound AI is rated a Strong Buy overall. The average price target for SOUN stock is $7.70, representing a potential upside of 48.65% from current levels.

SoundHound in Summary

SoundHound has shown remarkable growth, with its strategic acquisitions, such as Amelia, significantly broadening its offering. Even though there are worries about the current overvaluation and stagnating revenue growth, partnerships with major industries highlight SoundHound as a promising investment prospect with a potential for substantial returns, making it an attractive investment opportunity.