Shares of SoundHound AI (NASDAQ:SOUN) surged in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2024. Earnings per share came in at -$0.07, which beat analysts’ consensus estimate of -$0.09 per share. Sales increased by 73% year-over-year, with revenue hitting $11.59. This beat analysts’ expectations of $10.1 million.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Looking forward, management now expects revenue for FY 2024 to be in the range of $65 million to $77 million. For reference, analysts were expecting $69.49 million in revenue for 2024.

Investor Sentiment for SOUN Stock Is Currently Very Positive

The sentiment among TipRanks investors is currently very positive. Out of the 722,487 portfolios tracked by TipRanks, 0.9% hold SOUN stock. In addition, the average portfolio weighting allocated towards SOUN among those who do have a position is 5.24%. This suggests that investors in the company are fairly confident about its future.

In addition, in the last 30 days, 34.8% of those holding the stock increased their positions. As a result, the stock’s sentiment is above the sector average, as demonstrated in the following image:

Is SOUN Stock a Good Investment?

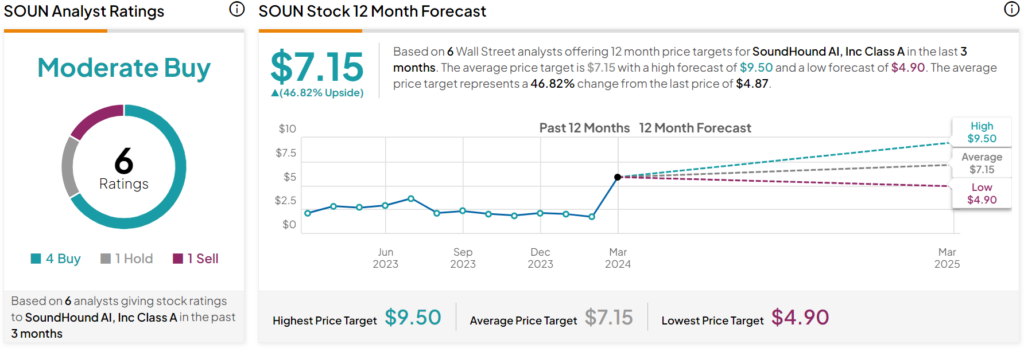

Turning to Wall Street, analysts have a Moderate Buy consensus rating on SOUN stock based on four Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. After a 91% rally in its share price over the past year, the average SOUN price target of $7.15 per share implies 46.82% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.