Sorrento sank 14% in extended market trading after the biotech company announced the ousting of its chief financial officer Jiong Shao.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The stock plunged to $10.62 in the after-market session after Sorrento (SRNE) said in a SEC filing that Shao’s employment “terminated in its entirety”, effective immediately. Shao served as the company’s Executive Vice President and CFO.

Sorrento announced the appointment of Najjam Asghar, 39, as the company’s CFO effective from Aug. 18. Asghar will serve as the company’s principal financial officer and principal accounting officer until a successor will be found. Asghar has been Sorrento’s Chief Accounting Officer since June 2019.

The company’s shares are down 13% over the past 5 days after Sorrento on Aug. 12 said that it believes it has uncovered “fraudulent” attempts to manipulate its stock. (See SRNE stock analysis on TipRanks). The disclosure follows a report by “Hindenburg Research”, which makes claims regarding one of Sorrento’s COVID-19 diagnostic products.

“The report is believed to include false and/or misleading statements for the sole apparent purpose of negatively manipulating the company’s stock price”, Sorrento said.

Sorrento added that it is considering legal action and will collaborate with law enforcement and regulators to ensure that any criminal activity is investigated.

Meanwhile, on a year-to-date basis, shares have had a stellar journey soaring 263% sparked by investor hopes for its COVID-19 test. Last month, Sorrento inked a licensing deal with Columbia University giving it rights to COVI-TRACE, a fast, one-step diagnostic test that samples saliva and can detect the SARS-CoV-2 virus in 30 minutes.

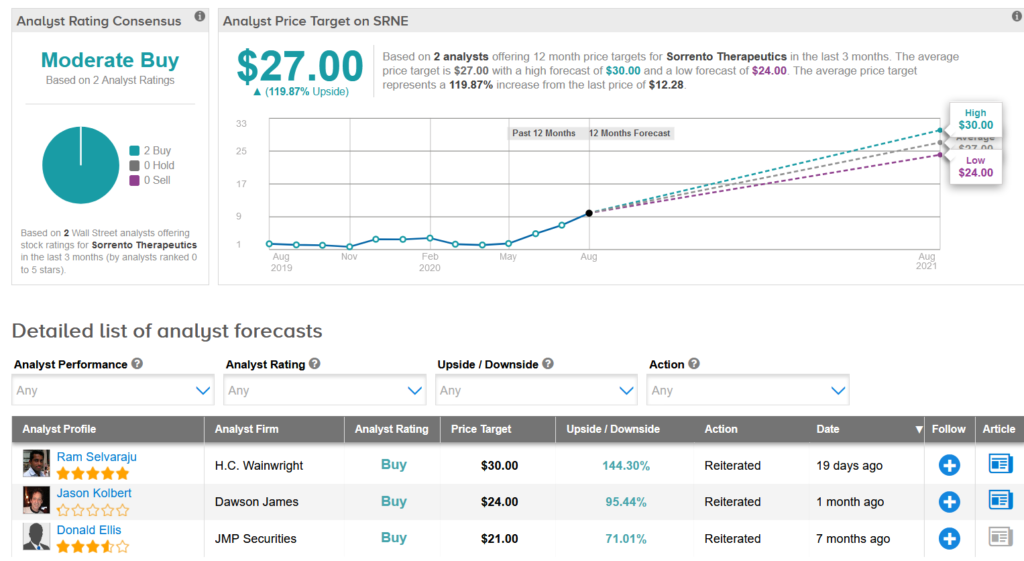

The deal prompted H.C. Wainwright analyst Ram Selvaraju to raise the stock’s price target to $30 (144% upside potential) from $24 and reiterate a Buy rating saying that the company may be positioning itself as a leader in addressing the pandemic, with multiple potential therapeutic approaches in its pipeline alongside the COVI-TRACK antibody test.

“We believe that the incentive to facilitate the large-scale and indeed ubiquitous deployment of the COVI-TRACE test is extremely high and governments worldwide may seek to implement this in their respective regions,” Selvaraju wrote in a note to investors. “Our current assumptions viewed in this context may be considered conservative—we utilize a $15 price per test and anticipate that roughly 56.5 million such tests could be conducted at peak annually, resulting in total sales of roughly $1 billion.”

The analyst added that the test “could conceivably be deployed at restaurants, airports, stadiums and other mass gathering areas.”

Overall, only one other analyst has rated the stock recently with a Buy rating, which provides Sorrento with a Moderate Buy consensus. At $27, the average analyst price target indicates another 120% upside potential in the shares over the coming year.

Related News:

Pfizer Inks Deal To Manufacture Gilead’s Covid-19 Remdesivir Treatment

Krystal’s ‘Promising’ Cystic Fibrosis Drug Scores Orphan Designation

Gilead ‘Very Pleased’ With Tango Collab, Boosts Cancer Targets To 15