Billionaire investor George Soros has revealed a stake in electric vehicle (EV) maker Rivian Automotive, Inc. (RIVN). RIVN stock closed down 9.1% at $58.85 on February 11.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The stock is bleeding after it made a disclosure on Thursday, declaring that it produced 1,015 EVs in 2021 and missed its own target of manufacturing 1,200 EVs in 2021. Out of these, Rivian has already delivered 920 vehicles.

Soros’ Stake in Rivian

Soros’ investment fund has disclosed a $1 billion stake in Rivian. In a Securities and Exchange Commission (SEC) filing of Friday, the Soros Fund showed that it acquired around 20 million shares of Rivian in the quarter ending December 31, 2021. At the time, Rivian shares were trading near $110 to $120, making the stake worth $2 billion.

However, RIVN stock has lost 42.7% year-to-date, pulling down the value of Soros’ investment to somewhere near $1 billion. Rivian debuted on the NASDAQ in November 2021 and also hit an all-time high of $179.47 in the same week.

Rivian is backed by huge investment from tech giant Amazon.com (AMZN) and auto manufacturer Ford Motor Co. (F). These companies saw their bottom lines boost in Q4 with the uptick in Rivian’s stock. However, it will be worth seeing the same stock impact their bottom lines in the current quarter, should the stock continue trading at its lows for the near term.

Apart from the Rivian stake, Soros’ Fund also disclosed its stake in other investments. The Fund has decreased its stake in tech giants Amazon.com and Alphabet (GOOGL) in the last quarter and also sold a part of its stake in the Invesco QQQ Trust Series 1ETF. Soros’ Fund has also taken a stake in battered gymnastic equipment maker Peloton Interactive (PTON).

Analysts’ Take

In a Semi’s Weekly Report on Automotive Technologies, Mizuho Securities analyst Vijay Rakesh reiterated a Buy rating and $145 price target on the stock, which implies a whopping 146.4% upside potential to current levels.

Commenting on his optimistic view of the stock, Rakesh said, “We see RIVN as a pure play and strong early mover in the EV market with a focus on the higher-growth SUV and light truck market and a strong commercial vehicle roadmap beginning with Amazon. Rivian is also poised to benefit from improving costs with scale and a well-laid-out path towards further vertical integration giving more control to production and delivery of vehicles.”

Overall, the stock has a Moderate Buy consensus rating based on 11 Buys and 4 Holds. The average Rivian price target of $133.21 implies 126.4% upside potential to current levels.

Stock Investors

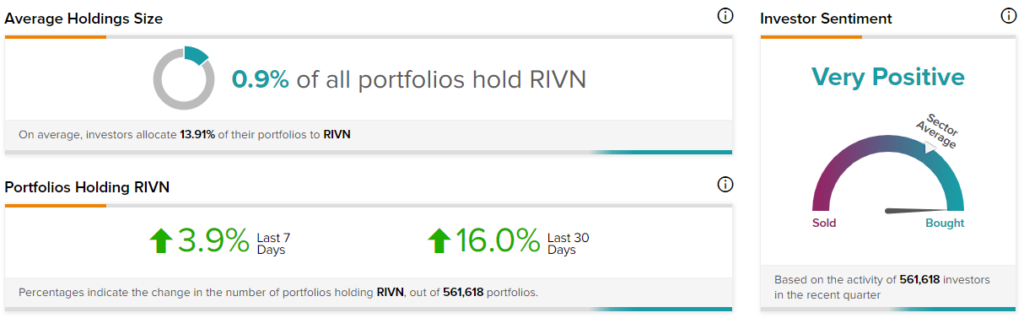

TipRanks’ Stock Investors tool shows that investor sentiment is currently Very Positive on Rivian, with 16% of portfolios tracked by TipRanks increasing their exposure to RIVN stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Cloudflare Delivers Solid Q4 Results; Shares Up

Kellogg Exceeds Q4 Expectations; Shares Pop 5%

PepsiCo Falls 2% Despite Exceeding Q4 Expectations, Cites Inflationary Pressures