SoftBank Group (SFTBF) is shaking things up with a colossal $3.4 billion buyback, addressing investor pressure to boost its stock price. Japanese tech investor SoftBank announced on Wednesday that it plans to repurchase up to 6.8% of its shares, worth a staggering 500 billion yen over the next year. This move partially answers calls from Elliott Management and other investors who have been clamoring for action.

Addressing Investor Demands

Elliott Management, a U.S. activist investor, has been particularly vocal, pushing for a $15 billion buyback program. Elliott has also rebuilt a stake in SoftBank worth more than $2 billion. The pressure was mounting as SoftBank’s market capitalization was significantly lower than the combined value of its assets.

SoftBank’s Financial Turnaround

Amidst this buyback news, SoftBank also reported improved financial results. They posted a narrower quarterly net loss of 174.3 billion yen, a significant improvement from the 477.6 billion yen loss a year earlier. Remarkably, SoftBank swung to a net income profit of 10.5 billion yen for the period.

Rebuilding After Setbacks

SoftBank has been on a mission to rebuild its finances, especially after the high-profile failure of WeWork and declining investor interest in some of its Vision Fund tech firms. With $26 billion in cash as of March, the company is strategically maneuvering through market challenges.

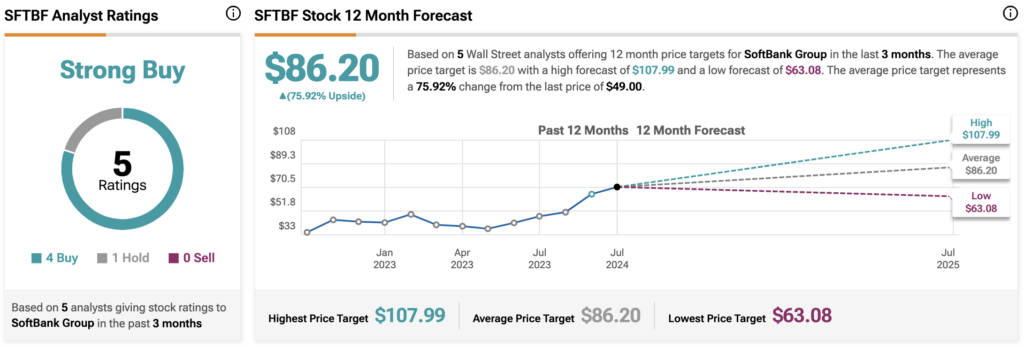

Is SoftBank Group a Buy?

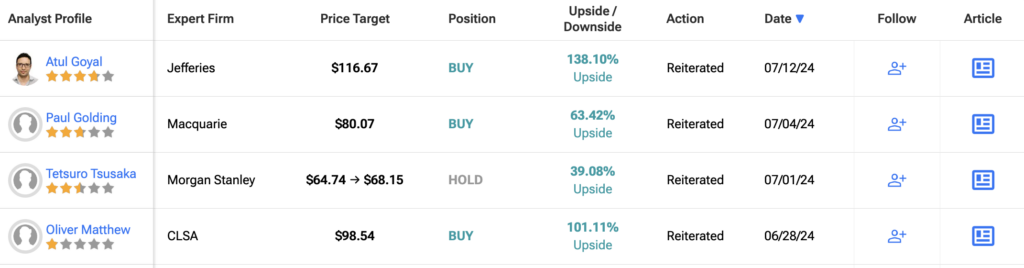

The announcement comes amid significant market turbulence, particularly for large-cap Japanese stocks and major tech companies. SoftBank’s shares took a hit, dropping almost 20% on Monday but have since shown signs of recovery. This could mean that the shares are significantly undervalued. It seems like many analysts seem to agree as they have deemed SFBTF shares a Strong Buy. The average SFBTF price target is $86.20, implying an upside potential of a whopping 75.9% from current levels.