The stock of SoFi Technologies (SOFI) is recovering following a sharp 7% decline in its share price after the financial technology company delivered its financial results for this year’s third quarter.

SOFI stock is trading near $11 per share, having clawed back nearly all the ground it lost after its Q3 print. SoFi Technologies’ share price is now up 2% over the last five trading sessions. The reversal comes as analysts and investors digest the company’s latest results and forward guidance.

The company’s stock had fallen despite SoFi beating Wall Street forecasts on the top and bottom lines and adding more than 756,000 new customers, bringing its total customer count to 9.4 million. SoFi, which offers student loans, personal loans, and a range of financial services, now has $24 billion worth of deposits.

Profit-Taking and Confusion

SoFi Technologies also raised its forward guidance, saying it expects revenue of $2.53 billion to $2.55 billion for the current year and earnings of $0.11 to $0.12 per share. Wall Street had forecast revenue of $2.46 billion and earnings of $0.10 for the company’s entire year.

As for why SOFI stock fell after the company’s latest print, some analysts chalked it up to profit-taking. Analysts at Mizuho Financial Group (MFG) went so far as to suggest that investors were confused about Sofi’s stock and its associated risks, writing in a note to clients, “We believe bears are confused, as worries are unmerited.”

Mizuho has a Buy rating on SOFI stock and a $14 price target. The share price of SoFi Technologies is up 10% so far this year.

Is SOFI Stock a Buy?

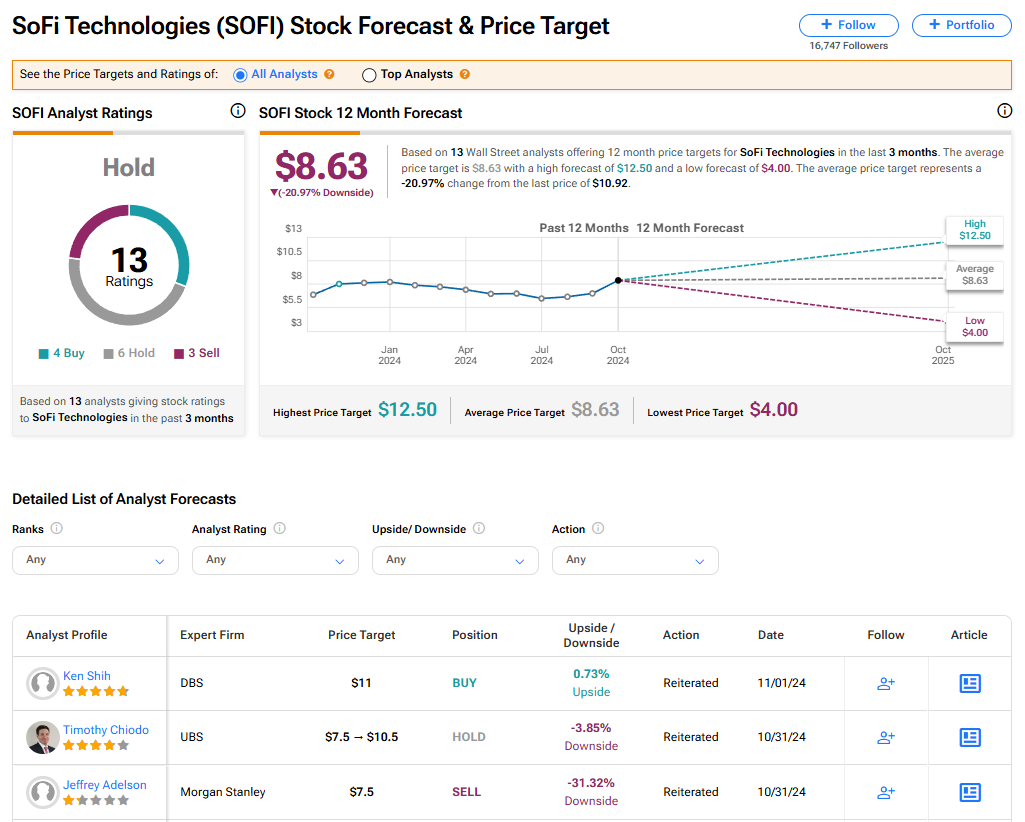

The stock of SoFi Technologies has a consensus Hold rating among 13 Wall Street analysts. That rating is based on four Buy, six Hold, and three Sell recommendations made in the last three months. The average SOFI price target of $8.63 implies 20.97% downside risk from current levels.