The stock of SoFi Technologies (SOFI) continues to rise even as the broader market, and technology stocks in particular, pullback.

SOFI stock was trading 1% higher at noon hour in New York on November 15 even as the technology-laden Nasdaq index was down more than 400 points or 2% amid a sharp downturn. The stock of the financial technology firm has now gained 93% in the last three months amid a sustained rally.

SoFi’s performance stands out when compared to other equities. Following a blistering rally immediately after the U.S. election on November 5, U.S. markets have turned downwards and are on pace for a negative week as the post-election rally sputters.

Strong Outlook

The stock of SoFi Technologies has been trending higher ever since the company issued strong third-quarter financial results at the end of October. At the same time, the company, which specializes in loans and credit cards, is expected to benefit from deregulation under a new Donald Trump presidency.

SoFi isn’t alone among fintech companies in seeing its share price rise. Post-election, several other fintech firms such as PayPal (PYPL) and Block (SQ) have also seen their stocks rise sharply, with some up more than 10% in a little more than a week.

Is SOFI Stock a Buy?

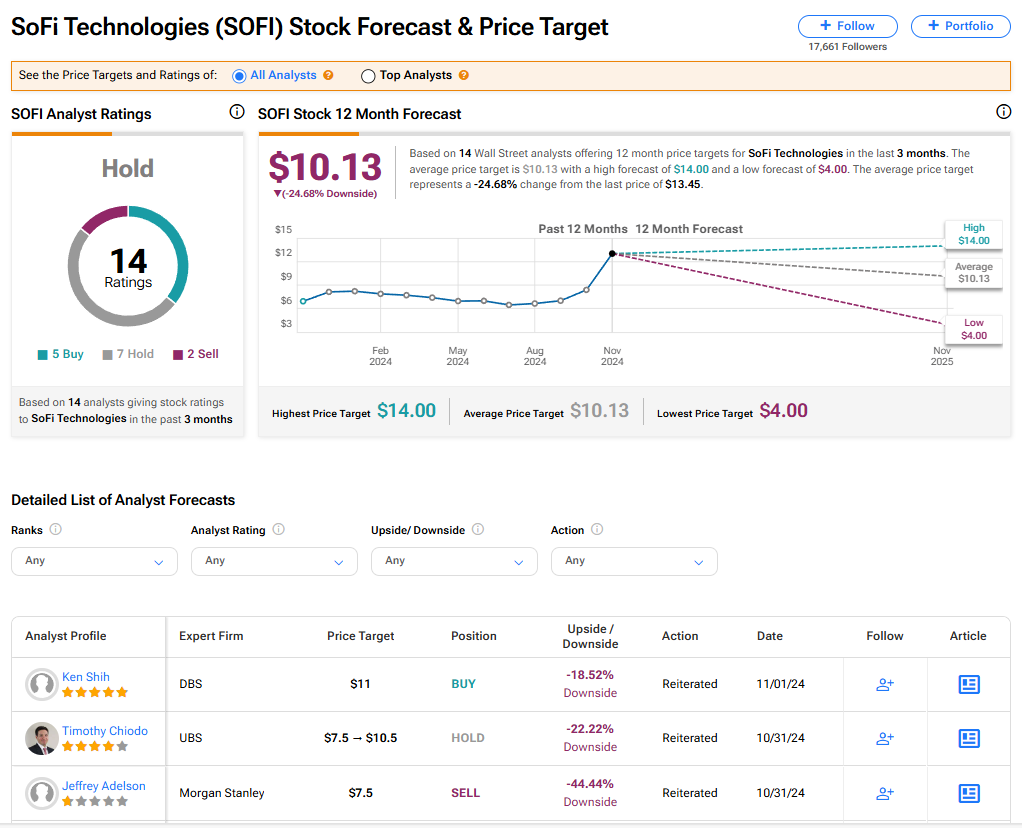

The stock of SoFi Technologies has a consensus Hold rating among 14 Wall Street analysts. That rating is based on five Buy, seven Hold, and two Sell recommendations issued in the last three months. The average SOFI price target of $10.13 implies 24.68% downside risk from current levels.