TipRanks understands the value of expert guidance in this investment landscape. That’s why we offer the Top Hedge Fund Managers tool, which enables users to closely monitor the investment choices of leading financial minds. The tool uses data from Form 13-Fs to offer hedge fund signals. Interestingly, SoFi Technologies (NASDAQ:SOFI) emerges as a stock these experts favor.

SoFi is a fintech company that offers student loan refinancing, personal loans, investing, and banking solutions.

Hedge Funds Accumulate SOFI Stock

The company’s revenue growth outlook appears promising due to the strong momentum in personal lending and the resumption of student loan repayments. Furthermore, SoFi’s average revenue per user is likely to increase with the launch of additional financial products.

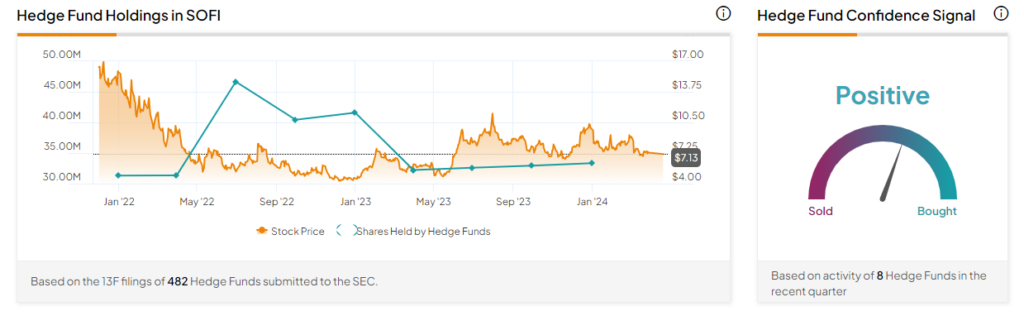

The Hedge Fund signal remains Positive for SOFI stock. TipRanks data shows that hedge funds bought 400,600 shares of the company last quarter, with Elkhorn Partners’ Alan Parsow and ARK Investment Management’s Cathie Wood raising their holdings in SOFI stock, among others.

Is SoFi Technologies a Buy, Sell, or Hold?

SoFi stock is down more than 28% year-to-date on weakness in the home loan refinancing market and headwinds from higher interest rates. However, on April 11, Mizuho Securities analyst Dan Dolev maintained a Buy rating on SoFi stock with a price target of $12 (68.3% upside). He expects SoFi’s recent convertible note offering to help boost personal loan originations in 2024.

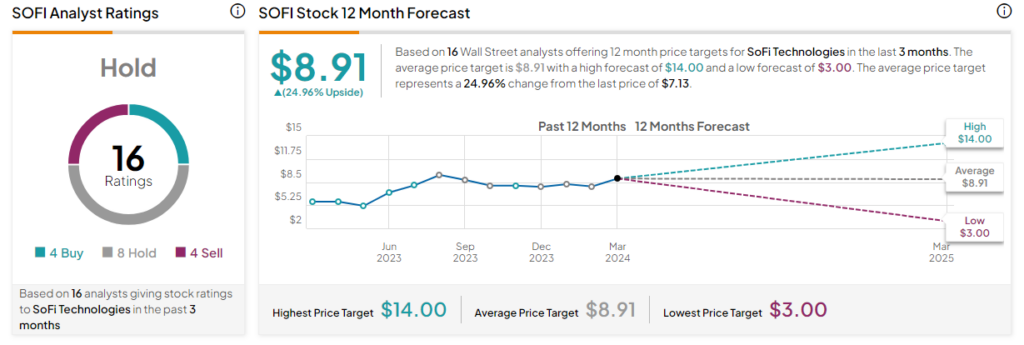

Meanwhile, Wall Street analysts remain sidelined on SOFI. The stock has a Hold consensus rating with four Buy, eight Hold, and four Sell recommendations. Analysts’ average price target on SoFi stock of $8.91 implies 24.96% upside potential.

Concluding Thoughts

SoFi has seen a rollercoaster ride in 2024. Despite surging 116% in 2023 due to strong member and revenue growth, the stock has pulled back this year. While SoFi boasts a loyal customer base and growth potential, rising loan delinquencies and a slowdown in home lending remain key concerns.

In the meantime, investors can use TipRanks’ Expert Center tools to make informed investment decisions.