SoFi Technologies (SOFI) declined by about 4% yesterday, ending its seven-day winning streak. The stock continues to trade about 1% lower at the time of writing. The fall in share price comes after the Biden administration announced plans to forgive $1.2 billion in student loans for public service workers.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

SoFi is a financial technology company offering a range of products, including student loan refinancing, personal loans, mortgages, and investment services.

Investors’ Concerns About Loan Forgiveness

While the program provides relief to borrowers, it has caused jitters among investors in student loan providers like SoFi, Navient (NAVI), and Nelnet (NNI). Following the announcement of the news, all three companies experienced a drop in their share prices.

This negative sentiment likely stems from concerns about reduced profitability, as forgiven loans mean lost interest and principal repayments.

Impressive Performance Past Week

It’s worth noting that SoFi’s stock rose 18% in the past week, likely due to optimism about its financial technology platform, Galileo, which had recently expanded its wire transfer services for other fintech companies.

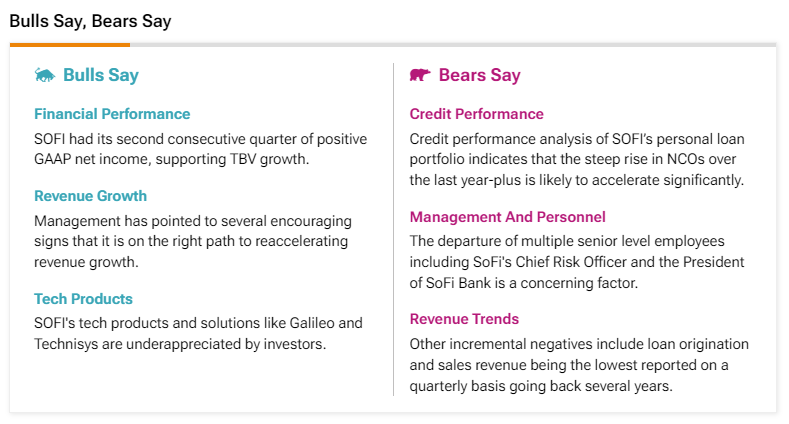

According to the TipRanks Bulls Say, Bears Say tool, analysts bullish on SOFI stock believe that the company’s tech products, like Galileo and Technisys, are undervalued by investors. This indicates potential for future growth, even with the current challenges from student loan forgiveness news.

What Is the Price Target for SoFi?

The analysts’ average price target on SOFI stock is $8.15, implying 8.23% upside potential.

However, Wall Street remains sidelined on SOFI stock. With four Buys, nine Holds, and three Sells, SOFI stock has a Hold consensus rating.