SoFi Technologies (SOFI) delivered solid Q2 2022 results that improved significantly from the year-ago quarter and beat Wall Street’s expectations. Also, the company raised its full-year guidance. The stock gained 0.79% on August 2 and rallied almost 8% in extended trading hours as investors reacted to the better-than-expected results.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

SoFi, which went public through a SPAC merger, provides digital financial products. It offers a variety of loan types and supports trading in stocks and cryptocurrencies.

SoFi’s Loss Narrowed in Q2

Revenue in the quarter increased 50% from the year-ago quarter to $356.1 million, beating consensus estimates of $340.87 million. The increase was driven by growth in all three of the business segments — Lending, Technology Platform, and Financial Services.

SoFi posted a loss per share of $0.12, a significant improvement from the loss of $0.48 per share in the year-ago quarter. It also beat consensus estimates as analysts expected the company to post a loss per share of $0.14. The company also registered an eighth consecutive quarter of positive adjusted EBITDA that landed at $20.2 million, an 81% increase from the year-ago quarter. The improvements came as the company experienced growth in members, products, and cross-buy, and benefited from a broad product suite.

Members and Products Growth

During the quarter, SoFi Technologies added over 450,000 new members. It exited the quarter with 4.3 million members, a 69% increase from the year-ago quarter. The company also added 702,000 new products, a 79% increase from the year-ago quarter.

Deposits in the quarter grew 135% from the year-ago quarter to $2.7 billion. Consequently, SoFi Technologies benefited from the lower cost of funding for loans. The increase also allows the company to benefit from a lower cost of funding for loans.

SoFi Technologies Ups Full-Year Guidance

SoFi Technologies now expects full-year revenue between $1.508 billion and $1.513 billion from initial guidance of $1.505 billion – $1.510 billion. Full-year EBITDA is expected at between $104 million and $109 million from the previous guidance of between $100 million and $105 million.

Wall Street is Cautiously Optimistic on SoFi Stock

The Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating, based on six Buys and five Holds. The average SoFi Technologies price target of $9.09 implies 41.8% upside potential from current levels.

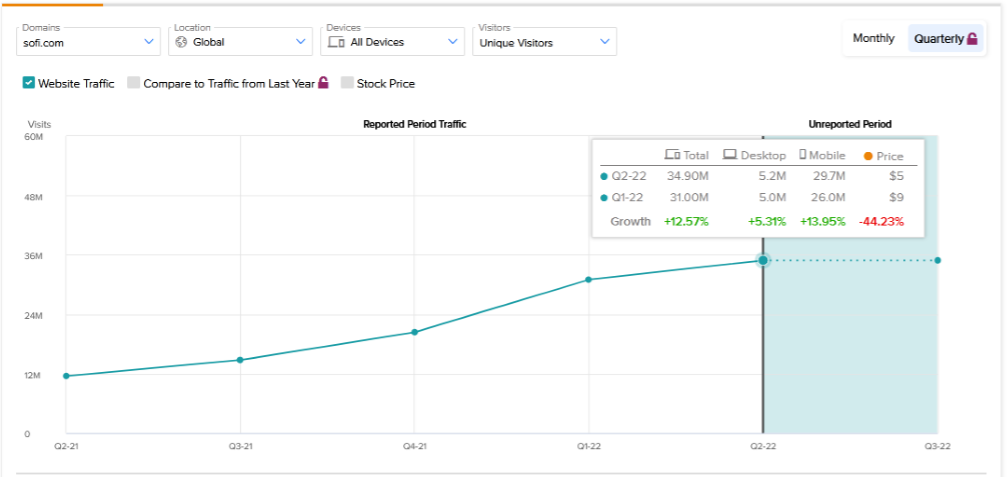

Rising Website Traffic Predicted the Strong Results

SoFi’s strong performance shouldn’t have surprised you if you have been a TipRanks user who leverages the website traffic screener. SoFi’s increased website traffic on a quarterly basis already indicated strong Q2 results.

According to the tool, the SoFi Technologies website recorded a 12.6% quarterly increase in global visits to 34.9 million in Q2 compared to the previous quarter. Furthermore, year-to-date, SoFi Technologies website traffic increased by 275.57%, compared to the same period last year.

Increased online activity affirms that the company is on the right path.

Learn how Website Traffic can help you research your favorite stocks

Key Takeaway for Investors

The impressive second-quarter figures show that SoFi Technologies is experiencing rapid growth. The strength in all the business segments should help the company to post solid full-year results and boost investor confidence.

Read the full Disclosure

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue