Shares of SoFi Technologies, Inc. (NASDAQ: SOFI) rose 1% in the extended trading session on Tuesday, after the American online personal finance company received regulatory approvals to become a Bank Holding Company.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

SoFi revealed that the Office of the Comptroller of the Currency (OCC) and the Federal Reserve have given a green light to the company to become a national bank through its proposed acquisition of Golden Pacific Bancorp, Inc. (GPB), and to operate its bank subsidiary as SoFi Bank, National Association.

The acquisition is expected to conclude in February, pending customary closing conditions.

Background

Last year, with the aim of gaining a national bank charter, SoFi inked an agreement through its subsidiary Social Finance, Inc. to acquire Golden Pacific Bancorp and its subsidiary, Golden Pacific Bank, N.A.

With the capital of $750 million, SoFi as a national bank will maintain GPB’s community bank business and footprint, which includes GPB’s existing three physical branches.

Official Comments

On achieving this milestone, CEO of SoFi Anthony Noto commented, “This incredible milestone elevates our ability to help even more people get their money right and realize their ambitions. With a national bank charter, not only will we be able to lend at even more competitive interest rates and provide our members with high-yielding interest in checking and savings, it will also enhance our financial products and services to ensure they efficiently meet the needs of our members, business partners, and communities across the country, while continuing to uphold a high bar of regulatory standards and compliance.”

Analysts’ Recommendations

Recently, Mizuho Securities analyst Dan Dolev maintained a Buy rating on SoFi, but lowered the price target to $17 (40.96% upside potential) from $30.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 7 Buys and 3 Holds. The average SoFi price target of $21.40 implies 77.45% upside potential to current levels. Shares have decreased more than 46% over the past year.

Risk Analysis

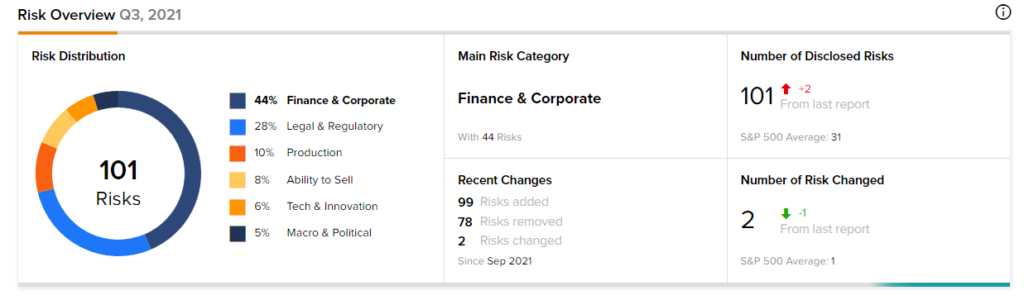

According to the new TipRanks Risk Factors tool, SoFi stock is at risk mainly from three factors: Finance and Corporate, Legal and Regulatory, and Production, which contribute 44%, 28%, and 10%, respectively, to the total 101 risks identified for the stock.

Given the already high-risk profile of the company, investors might want to be cautious before investing in this stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

AstraZeneca: FDA Priority Review for Enhertu could Boost Stock

AWS & TD Synnex Collaborates to Enhance Digital Offerings

Eli Lilly Inks Collaboration Deal with Abbisko