SoFi Technologies, Inc. (SOFI), a member-centric, one-stop shop for digital financial services, has reported a smaller-than-expected loss in the third quarter of 2021. Meanwhile, net revenues surpassed analysts’ expectations.

Following the news, shares of the company gained 12.4% in the extended trading session on Wednesday after closing 7.8% lower on the day.

Results in Detail

SoFi incurred a loss of $0.05 per share, lower than the Street’s loss estimate of $0.16 per share. The company had reported a loss of $0.70 per share in the same quarter last year.

Total adjusted net revenues generated during the quarter grew 28% year-over-year and stood at $277.2 million against the consensus estimate of $255.63 million. Notably, net revenues exceeded the company’s guidance of $245 million to $255 million.

Adjusted EBITDA came in at $10.3 million, reflecting the fifth consecutive quarter of a positive figure. (See SoFi stock charts on TipRanks)

In the Financial Services segment, total products increased 179% year-over-year to 3.24 million, mainly driven by SoFi Invest and SoFi Money offerings. Additionally, Lending products grew 15% to 1.03 million on the back of elevated personal and student loans.

Technology Platform accounts jumped 80% year-over-year to 89 million on the back of new client additions and a rise in existing Galileo clients.

During the quarter, total members surged 96% year-over-year to 2.9 million from 1.5 million, marking the second-largest quarter of new member additions at about 377,000. Additionally, total products more than doubled to 4.3 million from 2.1 million and represented the fifth consecutive quarter of triple-digit annual growth.

CEO Comments

In response to the third-quarter results, the CEO of SoFi, Anthony Noto, said, “The third quarter of 2021 capped a year-long sprint of great milestones, and we now have more flexibility than ever to execute and fund our long-term strategic growth plans and position SoFi as the ‘winner takes most’ in financial technology.”

See Insiders’ Hot Stocks on TipRanks >>

Guidance

For the fourth quarter of 2021, the company projects adjusted net revenue to be in the range of $272 million to $282 million, representing a growth of 49% to 55% year-over-year. Adjusted EBITDA is expected to land between $2 million and $5 million.

For 2021, the company expects to exceed its original guidance, with adjusted net revenue of $1.002 billion to $1.012 billion and adjusted EBITDA of $28 million to $31 million.

Wall Street’s Take

Following the solid third-quarter revenue beat and updated guidance, Rosenblatt Securities analyst Sean Horgan maintained a Buy rating on the stock with a price target of $30 (upside potential of 46.9%).

Horgan commented, “Net/net, we expect shares to trade higher on incrementally positive guidance and nearing upside catalysts (i.e., bank charter, student loan moratorium ending).”

Shares have skyrocketed almost 95% over the past year. The Street is bullish on the stock and has a Strong Buy consensus rating based on 5 Buys versus 1 Hold. The average SoFi price target of $24.58 implies 20.4% upside potential from current levels.

Website Traffic

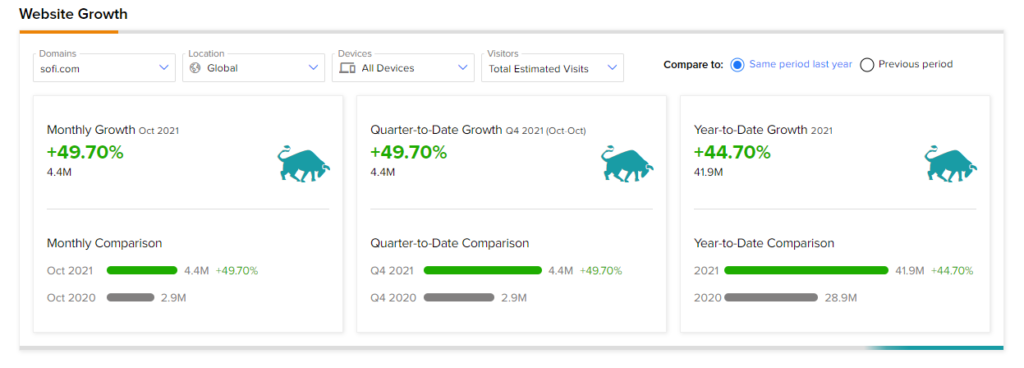

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into SoFi’s performance. According to the tool, the SoFi website recorded a 49.7% monthly growth, year-over-year, in global visits in October.

Notably, year-to-date website growth, compared to year-to-date website growth in the previous year, came in at 44.7%.

Related News:

Luminar Lidar to Integrate with NVIDIA DRIVE Hyperion AI Platform; Shares Jump

Amazon Expands in Alabama with New Operational Sites

Pfizer & Biohaven Join Hands for Commercialization of Rimegepant