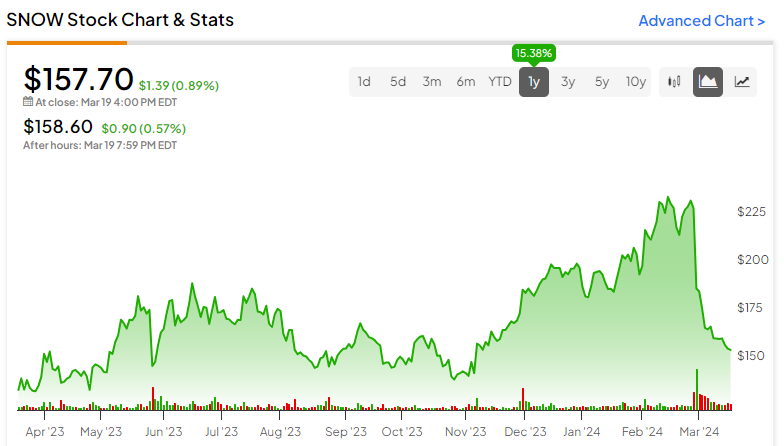

Snowflake (NASDAQ:SNOW), which offers pay-per-usage data-aggregation software, saw its stock tumble in late February after releasing mildly disappointing FY 2025 financial guidance. The stock’s over 30% decline since then reflects its previously high valuation, as it was trading at a forward P/E ratio of 209.4x, heightening sensitivity to minor setbacks. Now, with a more realistic valuation, Snowflake is drawing attention as a potential investment, leading me to adopt a slightly bullish outlook.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Why Did SNOW Stock Fall?

A key factor in Snowflake’s recent stock price decline from $236 to below $160 was the unexpected departure of CEO Frank Slootman at the end of February. Slootman, who held the position for five years and is highly respected by investors for his strong track record, took the market by surprise with his retirement. With Slootman’s successor, Sridhar Ramaswamy, now at the helm, there’s uncertainty about his effectiveness as the new CEO, contributing to the market’s apprehensive response.

Another reason for the decline was the firm’s financial guidance for Q1 2025 and FY 2025, which underperformed Wall Street expectations. The company forecasted Q1 2025 product revenue at $745 million to $750 million, well below analysts’ $768 million consensus estimate. For FY 2025, the company predicted $3.25 billion in product revenue, short of the $3.43 billion consensus estimate. This less-than-anticipated guidance heightened investor uncertainty, affecting the stock’s performance.

Bloomberg recognizes product revenue as a key metric for Snowflake, and the metric’s recent performance has significantly influenced SNOW’s stock downturn. Concerns stem from Snowflake’s consumption-based business model; amid a slowing U.S. economy, investors worry about reduced demand impacting the company’s financial health.

Despite these concerns, Snowflake maintains a competitive edge as cloud giants Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Google (NASDAQ:GOOGL) (NASDAQ:GOOG) continue to offer its platform to their customers, recognizing its ability to share vast data sets efficiently. While Snowflake’s revenue growth is expected to slow in the coming year, its stock remains attractive, buoyed by a more reasonable valuation, capacity to leverage AI trends, and recent history of solid growth.

Snowflake: Paving the Way for Widespread AI Adoption

Snowflake provides data analytics software tailored for cloud-computing platforms and has broadened its scope to include cloud data management solutions. Through its data warehouse, customers have the capability to seamlessly share data with partners using multiple online storage systems. With these capabilities, Snowflake is positioned to capitalize on the increasing adoption of generative AI.

Several analysts concur. In a recent report, RBC Capital analyst Matthew Hedberg noted, “We believe a comprehensive data strategy is a precursor to a gen AI strategy. As such, we believe Snowflake is well positioned given the large amount of customer data on their platform and new gen AI offerings that should help drive incremental workload utilization.”

Snowflake’s business model primarily centers on data consumption, an approach that aligns well with current market trends and is under close scrutiny for its effectiveness. Last fall, Snowflake unveiled Cortex, a comprehensive, fully-managed service that provides access to advanced large language models (LLMs). LLMs enable users to interact with AI using simple prompts, like search queries, without requiring algorithm knowledge.

However, the growing acceptance of AI is not the only reason to be optimistic about SNOW. The company is also bolstering its position through a significant expansion of its partnership with Amazon Web Services (AWS).

As a key aspect of this agreement, Snowflake has pledged $2.5 billion in AWS-related expenditures over the next five years. The partnership aims to broaden the development of industry-specific solutions, enhance product integrations, and boost sales and marketing collaborations. Currently, Snowflake and AWS have over 6,000 joint customers, with about 84% of Snowflake’s customers using AWS for cloud workloads.

Snowflake Contends with Slower Growth

Snowflake’s recent financial forecast points to slower growth in the coming months. Despite exceeding expectations in Q4 2024, with product revenue of $738.1 million, a 33% year-over-year increase, the company’s outlook for Q1 2025 indicates a pace that doesn’t align with analysts’ earlier expectations. This signals a potential change in its growth trajectory.

Looking ahead, Snowflake’s FY 2025 guidance predicts only a 22% increase in product revenue, a significant slowdown compared to the 38% growth in FY 2024. The company’s operating income margin guidance for the fiscal year is 6%, marking a two-percentage-point decline from 2024.

On the earnings front, Snowflake reported adjusted EPS of 35 cents for Q4 2024, surpassing analysts’ expectations of 18-cent EPS. The consensus EPS estimate for Q1 2025 is 17 cents. Despite these strong earnings, Snowflake faces challenges, as evidenced by its return on assets (ROA) of -8.48% for the last 12 months, which lags behind industry averages. This suggests potential difficulties in maximizing returns from its assets, which could impede peak financial performance.

Is SNOW Stock a Buy, According to Analysts?

TipRank analysts have rated SNOW as a Moderate Buy based on 24 Buys, nine Holds, and two Sell ratings given over the past three months. The average Snowflake stock price target is set at $212.23, implying 34.6% upside from its last price. These analyst price targets for the next year exhibit a wide range, with the lowest being $150.00 per share and the highest reaching $260.00 per share.

Final Analysis on SNOW

The recent decline in SNOW’s stock price offers investors a more attractive buying opportunity, as the valuation now appears more sustainable. While metrics like return on assets present a varied outlook, SNOW still displays several strengths. In the long run, the company will be able to capitalize on the increasing demand for data sought by AI. Additionally, its strategic partnership with AWS is poised to further support Snowflake’s growth.