Shares of Snowflake (NYSE:SNOW) plunged over 20% in after-hours trading after the data warehousing giant guided for a slowdown in revenue growth and announced a new CEO. The company anticipates its product revenue to grow by 22% to about $3.25 billion in Fiscal Year 2025 compared to the 38% growth recorded in Fiscal Year 2024. It also forecasted its adjusted operating margin to dip by 2% to 6%.

For the upcoming quarter, Snowflake expects its product revenue to range between $745 million and $750 million, marking a 26% to 27% year-over-year increase.

Nevertheless, Snowflake reported solid fourth-quarter results that exceeded analysts’ expectations. The company saw a 32% increase in revenue to $774.6 million, beating estimates of $760.4 million. Adjusted earnings of $0.35 per share beat analysts’ consensus estimate of $0.18 per share. Additionally, its remaining performance obligations grew by 41% to $5.2 billion, with net revenue retention coming in at 131%.

However, the biggest surprise came when Snowflake announced the retirement of CEO Frank Slootman. Sridhar Ramaswamy is set to take the helm immediately and join the board while Slootman transitions to chairman of the board.

Is SNOW a Good Buy Right Now?

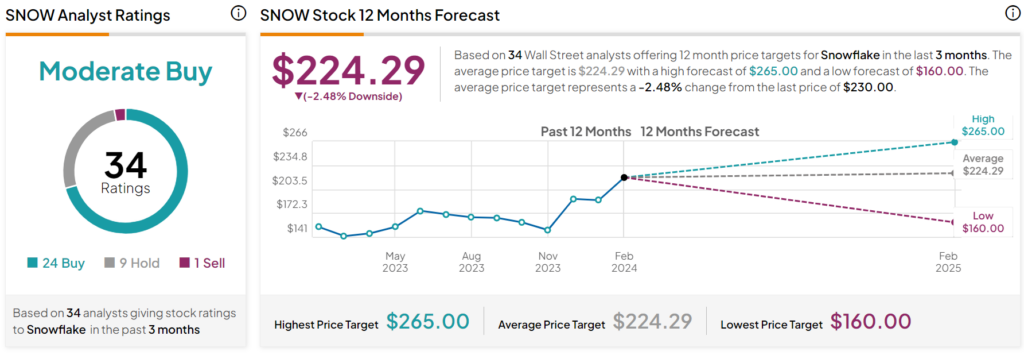

After a 49% rally in SNOW shares over the past year, analysts have a Moderate Buy consensus rating on SNOW stock based on 24 Buys, nine Holds, and one Sell with an average price target of $224.29 per share. However, it’s worth noting that estimates will likely change following today’s earnings report.